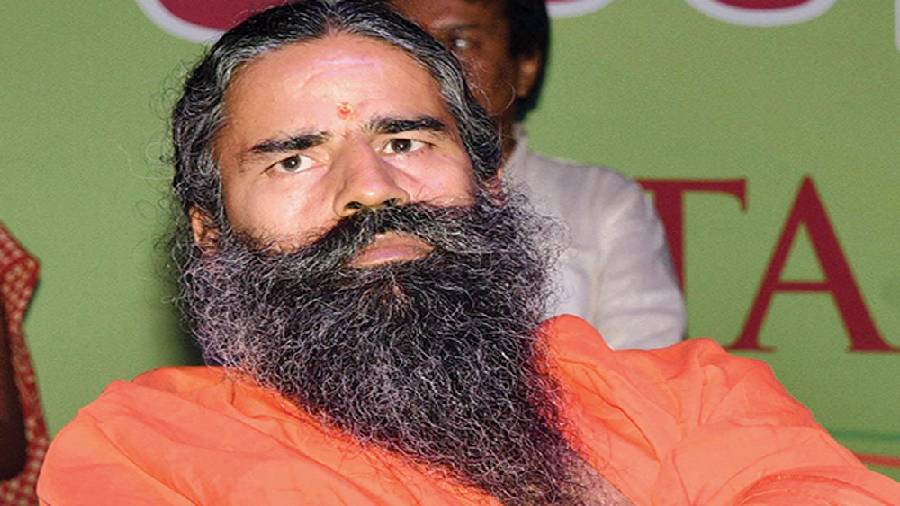

Has the mystique of the mystic who was once closely linked to the Modi regime started to fade?

The question hung tantalisingly in the air after the Bombay Stock Exchange and the National Stock Exchange decided on Wednesday to freeze over 292.58 million shares held by the promoters in Ramdev-run Patanjali Foods — representing 80.82per cent of the total equity— for failing to comply with market regulator Sebi’s rules relating to minimum public shareholding in a listed entity.

Under Sebi’s Securities Contracts (Regulation) Rules, 1957, a listed entity must have a minimum public shareholding (MPS) of 25 per cent. The decision by the bourses to freeze promoter shares for failure to comply with public shareholding rules is rare — and stock market watchers could not immediately remember when such precipitate action had been taken before.

More than 6,000 companies are listed on the stock markets and there is evidence that many may not have fully complied with the public float rule. To be fair, the bourses and the market regulator have been threatening to crack down on the companies that fail to comply with the rule — but have rarely acted.

Until now.

Self-styled yoga guru Ramdev had acquired Ruchi Soya, through an insolvency process for Rs 4,350 crore, in 2019. In May last year, the company announced the acquisition of the food business of Patanjali Ayurved for Rs 690 crore. After this merger, the name of Ruchi Soya was changed to Patanjali Foods. After Ruchi Soya was acquired, the aggregate shareholding of the promoter and promoter group in Patanjali Foods stood at 98.87 per cent of the total issued, paid-up and subscribed equity share capital of the company.

The listing rules of the bourses say that if the public shareholding falls below 10 per cent, it should be increased to this level within a maximum period of 18 months from the date that it dips below the threshold. To comply with this provision, the company had come out with a follow-on public offering (FPO) in 2022 wherein it issued 66,153,846 equity shares aggregating Rs 4,300 crore. As a result, the public shareholding level rose to 19.18 per cent. Patanjali Foods was required to raise the public shareholding to 25 per cent within a maximum period of three years. That deadline ended on December 18, 2022. Since this was not done, the stock exchanges decided to freeze the promoter shares.

The bourses have now frozen the shares of 21 Patanjali group entities and persons. They include Patanjali Foods chairman Acharya Balkrishna, who is a close associate of Ramdev, Patanjali Ayurved Ltd, Patanjali Parivahan, and Patanjali Gramodhyog Nayas. On Thursday, Sanjeev Asthana, CEO of Patanjali Foods, tried to play down the crisis. “Our promoter shares were already locked in till April 23. So, to that extent, it is not as if we were planning any sale of shares…. We are actively working on a dilution of up to 6 per cent,” he told a news channel.

He said investors were interested in picking up shares in the company but the markets needed to be conducive before the company could come out with an FPO in order to attain the public float threshold. The Adani group was forced to scrap the FPO of Adani Enterprises, the group’s flagship, in controversial circumstances in early February after US short-seller Hindenburg Research came out with a damaging report. It sparked an over 70 per cent fall in the market capitalisation of the Adani group’s listed entities. Recently, the Supreme Court set up a committee of experts to come out with a report on the market turmoil within two months.

Viewed in that context, it is a little surprising to see bourse authorities single out Ramdev’s Pantanjali Foods for such action. In a statement, Patanjali Foods said the action taken by the stock exchanges would not have any impact on its financial position. The company said the promoters were discussing various options to comply with the public shareholding rules and were “confident” of achieving the public float threshold in the next few months. The company added that none of the promoters’ shares had been pledged with any lenders.