Rajat Gupta with granddaughters Meera and Nisa, the day before he went to prison

As the plane slowly made its final descent, I looked out the window at the familiar smoky skyline and bustling chaos of Mumbai. I could almost hear the cacophony of car horns, bicycle bells, and human voices. And I could imagine that somewhere down there, on a protected rooftop above the city streets, a handful of young boys were gleefully flying kites, as my childhood friends and I had loved to do. After the drama with the Goldman board a month earlier and the ongoing tension of the past few months, I was happy to be back in my homeland and far away from it all.

It was early April 2010, and I had come to India for a couple of days of fieldwork with fellow P&G board members before their annual board meeting in Singapore the following week. Maybe the distance would help me to finally put the worrying rumours behind me, I thought to myself as the wheels touched down. And then I switched on my phone.

“We’re running a story tomorrow about the fact that you are under investigation for allegedly providing tips to Raj Rajaratnam about Goldman Sachs.” The voicemail was from a reporter at the Wall Street Journal. She had left a number, and asked me to call before a certain time if I had any comments, but by the time I got the message it was already too late. The story had gone to print.

“Goldman Director In Probe”, declared the headline. My inbox and voicemail were full of concerned messages from friends and colleagues who had read the story on the front page of the morning paper. The article repeated the same vague allegations I’d already heard, with no more detail on the specifics. Of course, the reporter didn’t name the “people close to the situation” who had provided the information and I’ll never know for sure where the leak came from. But if the Securities and Exchange Commission (SEC) or the Justice Department wanted to plant seeds of suspicion in the public mind — and in the minds of future jurors — they couldn’t have chosen a better way to do so. With the wounds of the financial crisis still raw — beloved homes foreclosed, jobs lost, families struggling, futures uncertain — it wasn’t difficult to convince people to think the worst of anyone connected to the financial industry. In fact, one survey on community attitudes conducted in 2009 found that 74 per cent of jury-eligible New Yorkers blamed “senior-level corporate executives” acting with “greed and carelessness” for the economic crisis, and almost half the respondents believed that if the US government accused a senior-level corporate executive of committing financial fraud, he or she probably did it.

Despite this climate of suspicion, I was determined not to start acting like a guilty man. I wanted to maintain a semblance of normalcy in my professional life. I flew on to Singapore for the board meeting, accompanied by former American Express CEO Ken Chenault, who was also a P&G director. He was extremely supportive, offering to help in any way he could. The other P&G board members were also understanding, but I knew that not everyone would react this way. There were plenty who would be quick to judge. As Jim McNerney, a fellow P&G director and former McKinsey guy, said to me at the time, “Now you’ll find out who your real friends are.”

Many people assumed that following the article I would resign from all of my board seats, but I resisted this pressure. P&G, Genpact, Harman International and AMR Corporation (the parent company of American Airlines) were all aware of the situation and had made it clear they considered me innocent and wanted me to continue to serve as a director. P&G CEO A.G. Lafley and Genpact CEO Pramod Bhasin even spoke out publicly in my defence. Every one of the nonprofits I served felt similarly — from the Gates Foundation to ICC.

McKinsey had begun conducting an internal inquiry, and I spent many long hours meeting with their team and sharing everything I knew about [Anil] Kumar and Rajaratnam, as well as my own story. My lawyers, meanwhile, were trying to get more information on what, if anything, the SEC or the Justice Department thought they had on me. Through some legal back channels, they were able to learn a little about the contents of the wiretaps.

It appeared that there were two tapes in which Rajaratnam mentioned Goldman, one being the September 2008 recording of him telling one of his traders that he’d heard “something good” might happen to the bank, and another, from about a month later, in which he told one of his lieutenants that he’d been tipped off about a shortfall in Goldman’s earnings. In neither of these tapes was I named as the source, but some people clearly wanted to believe that I was. My lawyers, however, were quick to assure me these tapes had no legal merit. Not only were they vague, they were hearsay, which was not allowed by the rules of evidence.

“What about calls between Rajaratnam and me?” I inquired. “If they’ve been tapping his phone all this time, surely there would be recordings that show the kind of things we actually discussed?”

It turned out that there were seven recordings that featured my voice, of which six were simply voicemail messages requesting a call back. That was no surprise — in my attempts to recover my Voyager investment, I’d left dozens of such messages for Rajaratnam, and he rarely returned my calls. There was one longer recorded conversation from July 2008, the lawyers told me, but it contained nothing to do with insider trading. I did not particularly like the idea that someone had been secretly recording our call, but I knew I’d never given Rajaratnam any tips. What could the tape possibly contain that could incriminate me?

Lastly, we learned that they had call records showing that I’d placed calls to Rajaratnam on the days in question — calls that had not been recorded, but which they were imagining contained tips. I knew, of course, that this wasn’t the case — there was only one reason I was calling Rajaratnam in the fall of 2008, and that was the Voyager investment.

My lawyers continued to seem upbeat. If this was all the government had, they told me, it wasn’t enough to make a case. A couple of conversations that were clearly hearsay and never mentioned my name, plus a couple of phone records, does not amount to anything close to proof. This seemed reasonable enough to me. I also knew, as I reminded my lawyers, that Raj had plenty of other connections at Goldman — he was one of their best clients and had hired numerous former Goldman people to work at Galleon. Any number of people inside the bank could have been the actual tipper.

The spring and summer of 2010 was a strange and disconcerting time. I felt like I should be defending myself, yet I’d still not been charged with any crime. My lawyers repeatedly reached out to the SEC, asking them to let us know if I was under investigation so I could cooperate. But we heard nothing. Then, in August, we abruptly received SEC subpoenas for information about my investments and my contacts. After some negotiation, we agreed to hand over relevant parts. Things went quiet again, but I was under no illusion that this was a good sign. “Don’t you worry,” Gary told me. “Let us worry for you.” I worried anyway — but not as much as I should have.

In November, the SEC informed my lawyers they wanted me to come in and testify. I was relieved — finally I could tell my side of the story and straighten out this misunderstanding. My lawyers, however, were not happy about the timing. Rajaratnam’s trial was scheduled for January, and they were concerned that if I testified to the SEC, I’d end up getting dragged on to the stand as a defence witness. The trial had all the makings of a media spectacle, and the last thing I needed was to play a starring role. So we told the SEC I’d be happy to testify, but requested that it be postponed until after the Rajaratnam trial was over.

They refused. They also refused to give us any assurance that my testimony would be kept sealed. A date was set for December.

'I’ll just tell them the truth,” I told Gary. It was early December 2010, and we were meeting to prepare for my SEC testimony. “If they insist on bringing me in, I’ll just explain what those calls to Rajaratnam were actually about.”

But Gary was concerned this approach was too risky. We had not yet seen all the evidence, so we had no idea what they might bring up, he explained.

Excerpted with permission from Mind Without Fear by Rajat Gupta; Published by Juggernaut Books, 2019

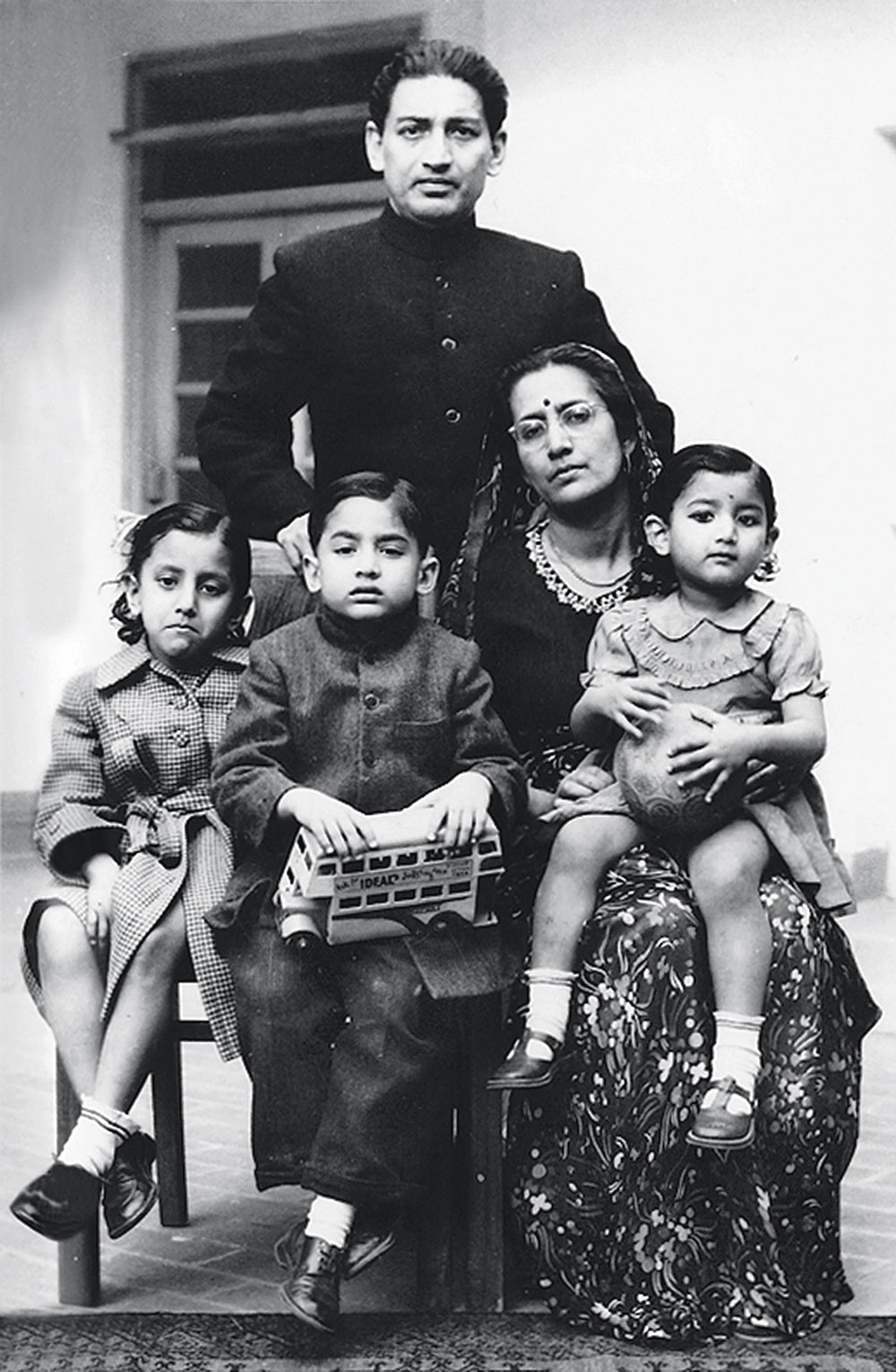

Rajat Gupta with parents Ashwini Gupta and Pran Kumari, and sisters Source: From the book

“What could they possibly have?” I demanded. “There is no evidence because there was no crime! And if I tell the truth, I don’t have anything to fear.” Their argument simply didn’t make sense to me, but Gary was adamant. The best strategy, he advised me, was to exercise my constitutional right against self-incrimination; in other words, to take the Fifth.

“That will just make everyone even more convinced I’m guilty!” I objected. I couldn’t see how this would be any better for my reputation than telling the truth. I could just picture the headlines: “Gupta Takes the Fifth: What Is He Hiding?”

Gary offered me an alternate way to say it: “Upon the advice of counsel, I respectfully decline to answer the question at this time based on my right under the United States Constitution not to be compelled to be a witness against myself.”

I looked at him sceptically. “I’m going to need to write that down.” So I did, and when the day of the testimony came, I took the piece of paper with me. We were shown to a small, nondescript, rather shabby room, and sat down. Soon three SEC agents entered, and introduced themselves as Sanjay Wadhwa, Jason Friedman, and John Henderson. I knew that Wadhwa a fellow immigrant, was a Punjabi, like my mother. Under different circumstances, I would have liked to ask him about his family and his history. Instead, I took a seat, with the piece of paper in my pocket for reference if needed, and waited for the questions to begin.

I don’t recall the opening question, but my answer was already prepared. I used the same phrase for each of the first few questions, feeling rather foolish, until Henderson suggested that for the sake of expediency I could simply abbreviate it to “I take the Fifth.”

Gary shook his head. “I don’t like that formulation.” So they agreed I could simply say “same answer”, which I did to every one of their fifty or so questions. It seemed a pointless and ridiculous exercise, and it felt terrible. Never in my life had I refused to answer when someone asked me a direct question, no matter what the consequences. I conceded to my lawyers’ insistence that this was the best course of action, but it made no sense to me. In hindsight, I think I made a mistake. I should have told my story. At least then they would have known the facts from my perspective.

That Christmas was a sombre one in our home. Although we are not Christians, my family had always enthusiastically embraced the holidays of our adopted country, and Christmas was traditionally a rowdy affair with a house full of family and friends. As 2010 drew to a close, however, no one really felt like celebrating. I was exhausted by the long-drawn-out game of cat and mouse with the SEC, and still frustrated by the ongoing lack of information. I was moving through my days in a kind of trance, feeling strangely disconnected from the events unfolding in my life. Try as I might, my usual strategic thinking abilities eluded me. It was hard to devise any kind of rational response to such an elusive and unpredictable adversary. I felt as if I were playing a chess game in which I couldn’t see my opponent’s pieces, and in which the rules were apt to change at any moment.

Another small piece came into view towards the end of January, when Rajaratnam’s co-defendant Danielle Chiesi, a teen beauty-queen-turned-analyst who extracted tips from her married lover and passed them on to her hedge fund boss, pleaded guilty. In the wake of her plea, yet another superseding indictment was filed, and this time, hidden in a sub-paragraph describing “overt acts” of one of several alleged conspiracies, was a reference to Rajaratnam passing a tip about Goldman to an associate. My lawyers seemed encouraged by this, explaining that it confirmed that the government didn’t have enough evidence to add a charge for the Goldman trades. If this was all they had on Raj, then surely whatever they thought they had on me was even more insubstantial.