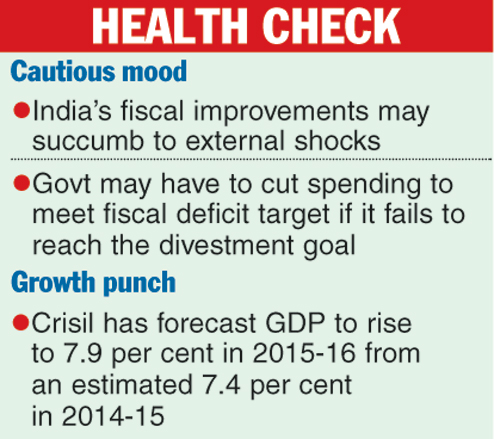

Mumbai, April 13: Standard & Poor's (S&P) today warned that fiscal improvements by India might succumb to external shocks and the Centre could again resort to spending cuts to meet the fiscal deficit target if it failed to reach the selloff goal.

The government has set a fiscal deficit target of 3.9 per cent for this fiscal and hopes to raise Rs 69,500 crore by divesting part of its stake in various PSUs.

In a report titled 'India's fiscal roadblocks could stall infrastructure progress'', S&P stressed further fiscal reforms without which the government could find it difficult to sustain the increase in public investment spending.

'Although India's budgetary performances have strengthened in recent years, its hard-won fiscal improvements could yet unwind because of a financial or commodity shock,' S&P's credit analyst Kim Eng Tan warned. He added that subsidy spending was a key source of weakness and heavy government debt was a major constraint.

At present, S&P has a BBB- rating on India with a stable outlook. Its observations come days after Moody's raised the country's rating outlook to positive from stable. Moody's had said an upgrade in the sovereign rating was possible in the next 12-18 months.

S&P said the Centre's budget deficit had fallen in recent years but it had to cut spending to prevent the deficit from widening.

'The government's willingness to cut spending to rein in the budget deficit indicates the high priority of fiscal prudence on its agenda. From an institutional and governance point of view, this supports the sovereign credit rating on India. However, structural fiscal weaknesses continue to be vulnerabilities of Indian sovereign creditworthiness,' Tan said.

However, S&P's Indian arm Crisil sounded optimistic on growth. It said India was now the fastest growing economy among the Brics nations (Brazil, Russia, India, China, and South Africa) and was no longer seen as part of the 'fragile five' (Turkey, Indonesia, Brazil, and South Africa). Crisil said the country's strengthening economy made it better prepared to face the volatility in capital flows arising from interest rates hikes by the US Federal Reserve.