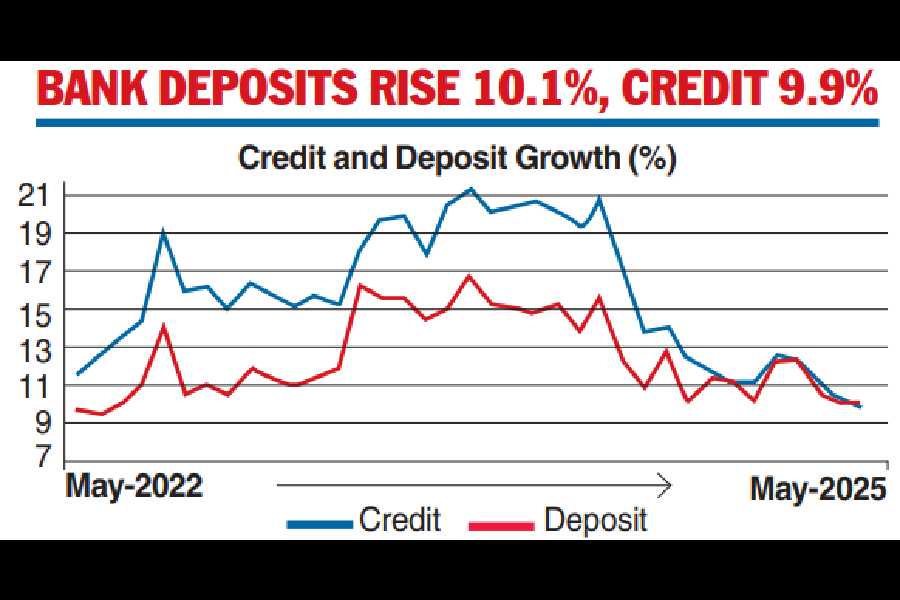

Credit growth of scheduled commercial banks (SCBs) continued on a downward trajectory in May, growing at a pace lower than that of deposits. Analysts expect credit demand to remain subdued amid heightened geopolitical tensions and the unpredictable trajectory of US tariffs, which also pose a question mark on the transmission of a 50-basis-point policy rate cut in the last monetary policy.

“SCBs’ credit growth moderated to 9.9 per cent, as on May 30, 2025, due to weaker momentum as well as unfavourable base effects. SCBs’ deposit growth decelerated from 10.6 per cent, as on March 21, 2025 to 10.1 per cent as on May 30, 2025, with the base and momentum effects offsetting each other,” said the RBI in its bulletin released on Wednesday.

The central bank said that the average bank credit growth to various sectors of the economy softened significantly during the period from April 2024 to April 2025. “Growth in non-food bank credit declined to 11.2 per cent during the fortnight ending April 18, 2025, from 15.3 per cent during the corresponding fortnight of the previous year.

This was driven by a moderation in the growth of credit to the services sector and agriculture. Personal loans growth showed deceleration over a year ago, though on a sequential basis, it saw an uptick after a softening in the last four months,” the May bulletin said.

In response to the 50 basis point rate cut between February and April 2025, the weighted average lending rate on fresh and outstanding rupee loans declined by 6 basis points and 17 basis points, respectively. On the deposit side, the weighted average term deposit rates on fresh and outstanding deposits fell by 27 basis points and 1 basis point, respectively.

The decline in deposit rates triggered criticism from Jairam Ramesh, who raised concerns over shrinking interest income, stating that savings account interest rates are at a 25-year low, impacting the elderly and middle class.

Santanu Chakrabarti, banking analyst at BNP Paribas India, noted that corporate loan growth will likely stay in single digits, as few promoters are expected to undertake major capex plans in the current uncertain climate.

The bulletin further said that high-frequency indicators for May have shown mixed demand trends. Urban demand softened, reflected through a decline in passenger vehicle sales. In contrast, rural demand improved, as reflected in higher two-wheeler sales.