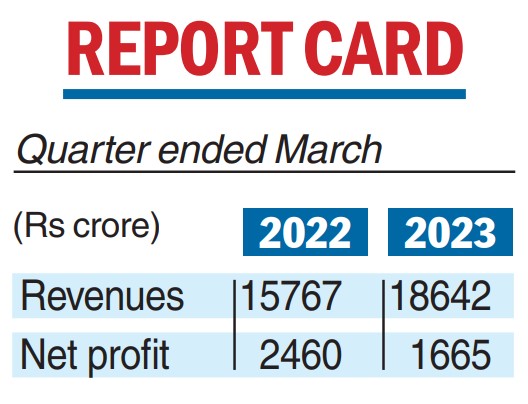

UltraTech Cement on Friday posted disappointing numbers in the fourth quarter of 2022-23, with consolidated net profits declining 32.29 per cent to Rs 1,665.95 crore as tax expenses of continuing operations jumped during the period under review.

The profit drop from the Aditya Birla group company which recorded a net profit of Rs 2,460.51 crore in the year-ago quarter comes a day after rival ACC which is now under Gautam Adani’s fold reported a 40.53 per cent decline in its consolidated net profit at Rs 235.66 crore in the same period against a profit of Rs 396.33 crore a year ago.

ACC’s standalone profit fell to Rs 236.57 crore from Rs 391.81 crore, down over 39 per cent. A restructuring cost of Rs 66.42 crore also contributed to the fall in the bottom line.

After acquiring ACC and Ambuja Cements, the Adani group which is looking to topple UltraTech Cement, has announced their plans to double capacity to 140 million tonnes (mt) by 2027-28.

While cement prices were muted during the quarter, Anil Singhvi, executive chairman at Shree Digvijay Cement, told CNBC TV-18 in an interview that prices were expected to rise either in May or June. Singhvi was the former managing director of Gujarat Ambuja Cement and he stepped down in 2007 after Narottam Sekhsaria sold his stake to Holcim.

UltraTech Cement has a consolidated grey cement capacity of 134.5mt, which is projected to rise to 160.45mt.

During the quarter, UltraTech Cement reported a current tax charge of Rs 800.82 crore and a deferred tax charge of Rs 21.48 crore against a tax credit of Rs 139.26 crore and deferred tax credit of Rs 58.73 crore in the year-ago period.

The quarter saw its revenues rising to Rs 18,642.38 crore against Rs 15,767.28 crore in the corresponding previous period.

Adani unit pre-pays $200m

Mumbai: The Adani group has reportedly pre-paid part of a loan taken to fund the purchase of Holcim’s cement operations in India.

According to a Bloomberg report, Adani Cement Industries Ltd pre-paid $200 million recently as part of a $1 billion mezzanine loan taken from global banks to fund the acquisition of Ambuja Cements and ACC that was completed last year.

The pre-payment will help the Adani firm seek an extension of the debt taken to fund the acquisition by three years. Global banks had provided Adani $4.5 billion to finance the purchase of Holcim’s cement assets, of which the mezzanine loan was due to mature in September 2024.

The group was hit by a report from Hindenburg Research alleging accounting fraud and stock price manipulation. Since then the conglomerate has been focussing on reducing its debt through prepayment and holding back on some of its planned investment programmes. While it has pre-paid over $2 billion of share-backed loans, there are also fresh reports that the group is looking to raise $1-1.5 billion for financing new green energy projects.