New Delhi, Sept. 2: A tussle has broken out over Calcutta-based Bridge & Roof between a section of the government, including Niti Aayog officials, which is in favour of a strategic divestment in the engineering company, and the heavy industries ministry that wants to merge it with Engineering Projects India Ltd (EPIL).

"We are working on a list of PSUs that are not of core concern to the government and how to deal with them. In that context, it has been suggested that we may consider Bridge & Roof for strategic divestment. However, the department of heavy industry, has in a written note, said it would prefer merging it with EPIL," top officials said.

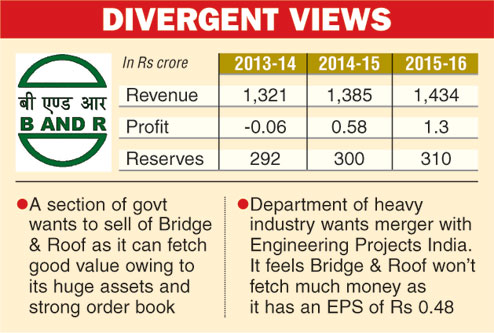

The note points out that Bridge & Roof may not fetch much money as its earnings per share is at a low of Rs 0.48 despite being a miniratna. "Against a turnover of Rs 1,720 crore (2015-16), the net profit is only Rs 5 crore. It is unlikely that much value will be obtained by the government if we disinvest the company."

The ministry has proposed that Bridge & Roof should be merged with engineering consultancy firm EPIL and become its projects implementation arm. A few years back, the government had considered listing Bridge & Roof but the idea was abandoned because of a turmoil in the market.

However, another section of the government, including officers of Niti Aayog, maintains that the company can fetch reasonable value if it is sold off given its huge assets and enviable order book.

The company manufactures railway wagons, Bailey type unit bridge, marine freight containers and bunk houses at its Howrah workshop. It also produces pot shells for aluminium smelters, railway bridge girders, fabricated pressure vessels and heat exchangers.

The government owns around 99.35 per cent in the company, with Balmer Lawrie and retail investors holding the rest. The 90-year old company, better known for its Bailey bridges and wagons, got the miniratna status a few years back.

Miniratna companies can incur a capital expenditure of up to Rs 500 crore on new projects, modernisation and the purchase of equipment without the government's approval.

Records with the central government are not very clear on the nationalisation of Bridge & Roof and Balmer Lawrie.

In 1970, Steel Brothers and Company of London had sold its stake in Indo-Burma Petroleum to Indian Oil, and it is believed that the sale placed the two companies with the government.