Tata Steel Ltd has decided to extend Rs 800 crore worth of financial support to Tata Metaliks Ltd to help its subsidiary efficiently manage working capital requirements amidst heightened volatility in the steel market.

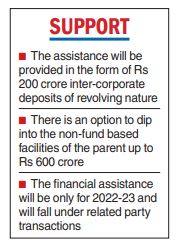

The assistance will be provided to the Calcutta-based company in the form of Rs 200 crore inter-corporate deposits (ICDs) of revolving nature and an option to dip into the nonfund based facilities of the parent up to Rs 600 crore.

The financial assistance is going to aid TML, which produces ductile iron pipe and pig iron at Kharagpur, better manage working capital at a time the Ukraine-Russia war has caused severe volatility.

TSL is the holding company of TML having 60.03 per cent stake. The development comes weeks after the city-based company completed the expansion of the DI pipe-making facility at an investment of Rs 600 crore.

The financial assistance will be only for the fiscal year of 2022-23 and fall under related party transactions. Consequently, TML has sought approval from the shareholders for the proposed transaction.

In the explanatory statement to shareholders, TML set out the rationale for the financial assistance. “Steel sector is going through frequent volatile cycles. The volatile commodity price environment is driven by the Russia — Ukraine conflict, associated sanctions and consequent supply chain disruptions. Volatile prices of commodities require a significant amount of working capital for the company,” the communication from the company, said.

It further added that the financial assistance “…will help the group ecosystem in ensuring secured and efficient utilisation of cash management and will bring synergy across companies by sharing the pool of resources as it will ensure consistent utilisation of capital at arm’s length”

While the resolution is being put to vote, Tata Steel is also embarking on simplifying the group structure which involves merger of all three listed subsidiaries, including TML, with the parent. One of the primary reasons for the amalgamation is to cut the regulatory clutter as driving synergies, strategies outside of the legal entities, that too listed, is much more difficult in today’s world.

Given the very large size of TSL’s balance sheet, compared to the listed subsidiaries such as TML, Tata Steel LongProducts and Tinplate Co, the parent had to always deviseingenious ways to finance the growth plans. TSL had to step in to support TTSL’s acquisitions of Usha Martin’s steel business in 2018 and NeelachalIspat Nigam in 2022.