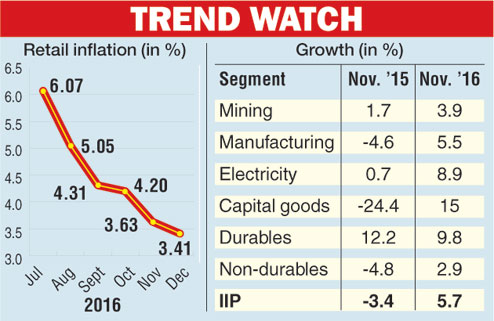

New Delhi, Jan. 12: Industrial production grew 5.7 per cent in November, a 13-month high, despite demonetisation, while retail inflation remained subdued at a two-year low of 3.41 per cent in December, government data showed today.

The growth in industrial output was driven by a surge in capital goods production and a surprise rise in consumer goods output, which economists warned could be because of a positive base effect and does not necessarily reflect a revival in industrial fortunes following demonetisation, announced by Prime Minister Narendra Modi on November 8.

Base effect relates to growth in the corresponding period of the previous year. If growth was too low a year ago, even a small rise in industrial output will arithmetically give a high rate of growth now. Factory output had contracted 3.4 per cent in November 2015. The IIP growth in April-November was, however, flat at 0.4 per cent against 3.8 per cent a year ago.

"The numbers are not surprising at all as the advance estimate of GDP put out by the CSO had indicated the kind of growth one could expect in industrial output. We should actually watch out for the December number, which is expected to give an estimate of the impact of demonetisation," Pronab Sen, former chairman of the National Statistical Commission, said.

N.R. Bhanumurthy of the National Institute of Public Finance and Policy said the "data seem volatile".

While capital goods rose 15 per cent, basic goods expanded 4.7 per cent and intermediate goods by 2.7 per cent. Surprisingly, consumer goods expanded 9.8 per cent and non-durables 2.9 per cent in November. "We should not read too much into this standalone data. Consumer goods growth seems surprising coming on the back of demonetisation."

"The improvement in the performance of capital goods was driven by rubber insulated cables, which tends to be a volatile component, and tractors, and should not be construed as a harbinger of an investment revival," principal economist of Icra Aditi Nayar said.

Rishi Shah, economist of Deloitte India, said, "The number is more likely to be an outlier given the uncertainty on account of demonetisation and the industrial growth momentum is likely to have slowed down in the near term."

Ficci president Pankaj Patel said, "It is heartening to note that the growth is broad-based and signals a positive jump in manufacturing production. Given the reduction in lending rates by banks, we hope to see an increase in both consumption and investment, which will have a positive impact on manufacturing growth."

Meanwhile, the cash crunch after demonetisation has dragged down retail inflation to 3.41 per cent in December from 3.63 per cent in November.

"The CPI inflation in December surprised on the downside, with a sharp decline in the price of vegetables, that benefited from a seasonal trend of softness in the winter months. Additionally, the adverse impact of the note ban on the bargaining power of producers of perishables can't be ruled out," Nayar said.<>

Overall, the consumer food price index fell to 1.37 per cent from 2.11 per cent in November. CPI-based inflation in fuel and light segment stood at 3.77 per cent against 2.80 per cent a month ago.

The decline in consumer price index (CPI)-based inflation has been mainly attributed to the falling prices of vegetables and pulses.

However, the note ban resulted in a moderation in retail inflation in December, reflecting weak demand.

Chief Economist, L&T Financial Services, added "there is a possibility of some degree of under-reporting of numbers in the previous month that is now getting normalised." Some important items showing high positive growth during the current month over the same month in previous year include 'Cable, Rubber Insulated' (185.0%), 'Tractors (complete)' (95.0%), 'Telephone instruments including mobile phone and accessories' (42.8%), 'Passenger cars' (29.5%), 'Aviation Turbine Fuel' (28.3%), 'Plastic Machinery including Moulding Machinery' (24.1%) and 'Sugar' (21.2%), Ministry of Statistics & Programme Implementation said.

The Central Statistical Office estimated that the Gross domestic product (GDP) could grow by 7.1 % in fiscal year 2016-17, far slower than a provisional figure of 7.6 percent a year earlier. However, the CSO chief TCA Ananth admitted that these projections would have to be reworked once date for the remaining months after demonetization were available.

The data showed that the manufacturing sector is expected to grow by 7.4 percent compared to 9.3 percent last year and the mining sector is expected to contract by 1.8 percent compared to growth of 7.4 percent last year.

Inflation

Retail inflation crashed to a 2-year low of 3.41 per cent in December, reflecting weak demand as consumers grappled with cash crunch following demonetisation. The decline in retail inflation has been mainly on account of falling prices of vegetables and pulses.

The Consumer Price Index (CPI)-based inflation stood at 3.63 per cent in November 2016, as per the data released by the Ministry of Statistics and Programme Implementation.

Economists said today's headline inflation figures should give the Reserve bank space to lower key interest rates. However, this could depend on the spending budget drawn up by Finance Minister Arun Jaitley in his forthcoming budget. A high expenditure and borrowing level in the budget could stay the RBI's hands in ordering a rate cut.

Aditi Nayar, principal economist with ICRA said "CPI inflation in December 2016 surprised on the downside, with a sharp decline in the price of vegetables, that benefited from a seasonal trend of softness in the winter months. Additionally, the adverse impact of the note ban on the bargaining power of producers of perishables can't be ruled out. Core-CPI inflation remained rather sticky in December 2016, displaying little reaction to the note ban."

"Although stronger crude oil prices have started transmitting into higher fuel prices, food items continue to display a moderation in January 2017. Based on the evolving trends, ICRA expects the CPI inflation to record one more sub-3.5% print in January 2017," she said.

A year ago, in December 2015, retail inflation was at 5.61 per cent. Inflation in vegetables category slipped further in the negative territory to (-)14.59 per cent, as against 10.29 per cent in November.

Overall, the Consumer Food Price Index was down at 1.37 per cent in December compared with 2.11 per cent in November. The CPI-based inflation in fuel and light segment was at 3.77 per cent in December as against 2.80 per cent a month ago.