Mumbai, Aug. 18: The State Bank of India today moved another step closer towards the creation of a Rs 37-lakh-crore banking behemoth with its board approving the merger of five associate banks and Bharatiya Mahila Bank Ltd (BMBL) with itself. The board also recommended swap ratios for the merger of three associate lenders and Bharatiya Mahila Bank.

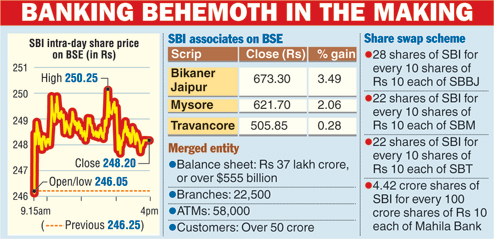

According to the swap ratio, the shareholders of State Bank of Bikaner & Jaipur (SBBJ) will receive 28 shares of SBI for every 10 shares held, while the investors of State Bank of Mysore (SBM) and State Bank of Travancore (SBT) will each receive 22 shares of the parent for every 10 shares. The shareholders of the Bharatiya Mahila Bank, which is not listed, will receive 4.42 crore shares of the SBI for every 100 crore shares.

The SBI holds 90 per cent in the Mysore arm, 75.07 per cent in the Bikaner & Jaipur associate and 79.09 per cent in Travancore. It holds 100 per cent in two other associates - State Bank of Hyderabad (SBH) and State Bank of Patiala (SBP) - that are not listed.

The SBI had proposed the merger in May. According to chairperson Arundhati Bhattacharya, the benefits of the merger will outweigh the costs to the parent, such as provident fund liabilities of around Rs 3,000 crore.

In separate board meetings today, the directors of the three listed associate banks also approved the swap ratio. Meanwhile, the SBI board approved the merger of the Hyderabad and Patiala arms with itself.

According to senior SBI officials, the merger will require the approval of both the Reserve Bank of India and the Government of India. The merger will be effective 30 days after a notification from the Centre in the official gazette. The merger will not require the approval of the Competition Commission of India.

The SBI and the listed associates had appointed independent valuers to fix the swap ratio. They also appointed investment banks to provide a fairness opinion on the valuation conducted by the independent valuers.

Swap benefit

While the announcement came after market hours, shares of all the three listed associates gained on the bourses. Based on the closing prices of these scrips and that of the SBI, initial calculations show that the swap ratio will benefit the shareholders of the Travancore and Bikaner arms, while investors of the Mysore bank could be in for disappointment.

The State Bank of Bikaner & Jaipur reported a loss of Rs 221.56 crore in the first quarter ended June 30. The bank saw its gross non performing assets rise to 6.20 per cent from 4.82 per cent in the preceding quarter.

The State Bank of Mysore, too, reported a loss of Rs 471.88 crore in the first quarter against Rs 94.07 crore in the same period last year because of higher provisions. The lender's percentage of gross NPAs to advances rose to 7.83 per cent from 6.56 per cent on a sequential basis.

Travancore, too, posted a loss of Rs 742.89 crore and the percentage of gross NPAs crossed the 9-per-cent mark to touch 9.38 per cent.

Bhattacharya had recently said this performance should be seen in the context of the associate banks aligning their respective asset quality reviews with that of the SBI. The reviews will be carried out in the second quarter as well and, thereafter, one could expect improved performance from these associate banks, she had added.