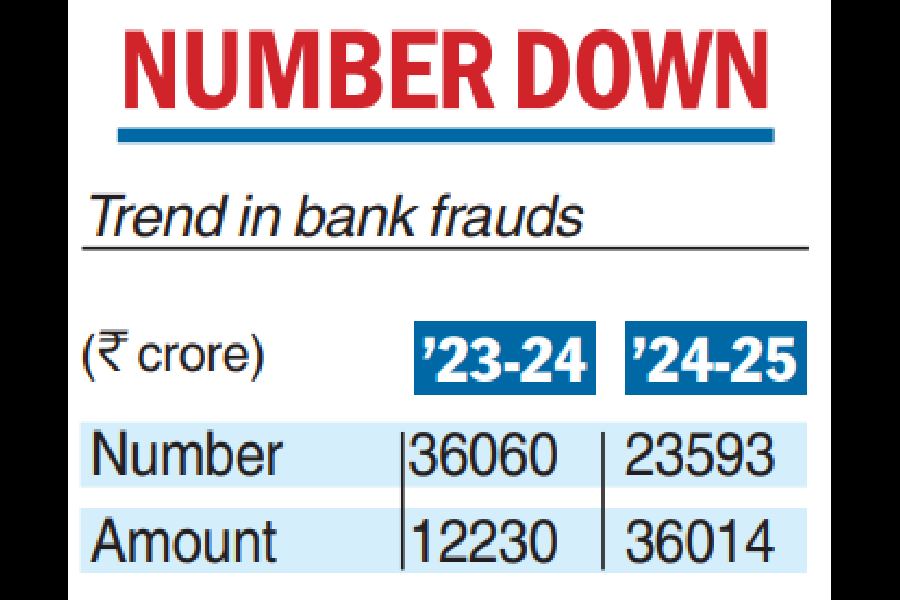

The amount of fraud in scheduled commercial banks has seen a sharp increase in 2024-25 to ₹36,014 crore from ₹12,230 crore in 2023-24, even as the number of frauds has seen a decline of 33.5 per cent from 36,060 in FY24 to 23,953 in FY25.

A group-wise break-up shows that public sector banks continue to lead in terms of the amount involved in fraud, contributing 71.3 per cent of the total amount of frauds in FY25. Private sector banks lead in terms of the number of frauds, constituting 67.2 per cent of frauds during the year.

A change in the classification following a 2023 Supreme Court verdict has contributed to the spike in the amount involved in frauds.

“The increase was mainly due to the removal of fraud classification in 122 cases amounting to ₹18,674 crore reported during previous financial years and reporting afresh during the current financial year after re-examination and ensuring compliance with the judgment of the apex court dated March 27, 2023,” the RBI said.

In its 2023 judgment, the Supreme Court had upheld a petition that sought natural justice and directed the banks to give time and offer a detailed explanation to the account holder and also asked the RBI to issue new directions towards the same.

Accordingly the RBI on July 15, 2024 came out with revised master directions, which stated that regulated entities will be required to issue a show cause notice to persons and entities against whom the allegation of fraud is being examined. Also, a reasonable time of not less than 21 days shall be provided to the persons/entities to respond to such a showcause notice.

A further breakdown of the data shows that frauds have occurred predominantly in the category of digital payments (card/internet) in terms of number, and primarily in the loan portfolio in terms of value. The number of card/internet frauds during the year stood at 13,516, representing 56.5 per cent of the total number of frauds, while frauds in the loan portfolio at ₹33,148 crore constituted 92.1 per cent of the total amount involved in frauds during FY25.

“While card/internet frauds contributed the maximum to the number of frauds reported by private sector banks, frauds in public sector banks were mainly in the loan portfolio,” the report said.

RBI’s plan

The RBI’s department of supervision plans to enhance liquidity stress tests for scheduled commercial banks through advanced cash flow analysis. This aims to assess banks’ ability to withstand extreme but plausible stress scenarios, ensuring they can meet obligations during crises. This forward-looking approach will help protect depositors and reduce systemic risks.

To combat rising digital fraud, the RBI will develop a framework with specific parameters to strengthen the operational resilience of digital channels in regulated entities and issue guidelines on digital forensic readiness. These measures aim to enhance the overall stability and security of the banking system.

Emerging frauds

Banking industry officials said the threat landscape is rapidly evolving, with fraud detection, particularly in the form of mule accounts, money laundering, QR-based frauds, and digital lending becoming a top priority. Digital banking fraud largely falls into two categories: account takeovers and scams involving self-initiated transactions.

Sameer Shetty, president and head of digital business at Axis Bank said the industry is investing in advanced technologies to ensure more secure and seamless transactions.

“At Axis Bank, we have already implemented host of features like BOT attack prevention, open-source monitoring for fake customer care numbers/social media handles/job & investment scams, remote access app detection etc.” Shetty told The Telegraph.