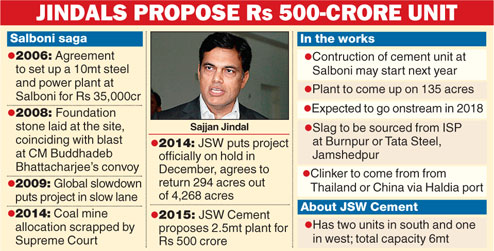

Calcutta, Aug. 16: Sajjan Jindal's JSW Group is going to make a fresh attempt to kick off the stalled projects at Salboni in Bengal with the proposal of a cement plant.

The $11-billion group has suggested building a 2.5-million-tonne slag-based unit at an investment of Rs 500 crore after it failed to build a steel and power plant over the last decade.

If everything goes according to the plan, the Mumbai-based conglomerate may start the project next year. The Salboni project was officially put on hold in December 2014.

However, the new proposal would be a pale shadow of the original plan hatched by JSW in 2006 when it signed an agreement with the Buddhadeb Bhattacharjee-government to invest Rs 35,000 crore in a 10-million-tonne steel and a 1,680MW power plant.

The plan then had also included a cement unit to utilise the slag generated from the blast furnace of the steel plant.

But now the cart will be put up before the horse as the cement plant will come up ahead of steel and power. "We want the ball rolling at Salboni. The cement project will create an atmosphere of excitement in that area," Biswadip Gupta, a senior executive at JSW who is looking after the company's interest in Bengal for years, said.

Jindal had put the steel project on hold after a series of clampdown on iron ore mining by the Supreme Court queered the availability of the raw material in Bengal, which has no deposit of the metal.

The power projects then fell through when the apex court scrapped allocations of three Bengal coal mines last year along with 200 more in the country.

JSW, the largest private producer of steel in India, says there will be no problem sourcing key raw materials, slag and clinker (a derivative of limestone), for the cement unit.

Pankaj Kulkarni, director of JSW Cement, said the plant would source slag from ISP at Burnpur or Tata Steel Jamshedpur, which is only 120km away from this West Midnapur town.

"We will import clinker from Thailand or China through Haldia port and haul it by rail," Kulkarni added.

Initially JSW Cement, which has three units in the south (Nandiyal in Andhra Pradesh, Vijaynagar in Karnataka) and west (Dolvi) with a combined capacity of 6 million tonnes, had considered a port-based plant and apparently looked at 3-4 locations for Bengal operations before zeroing in on Salboni, 155 km from Calcutta, where it has around 4,000 acres in possession.

Jindal will use only a fraction of the precious land parcel, one of the largest among any private player, for the cement plant. It will require 135 acres, or around 3.5 per cent of the land parcel held from 2008.

JSW Cement has applied with the state government, seeking to "assign" the plot to JSW Cement from the existing company so that it can raise a loan against it. Gupta said the plant and machinery had been ordered from KHD of Germany.

Around 1,000-1,200 people will be required for construction. Once the plant comes to production around 2018, the company will employ about 200 people. Even though it will be good news for the region, a hotbed for Maoist trouble a few years back, the employment opportunity, direct and indirect, will be only a fraction of a steel plant.

For the industry-starved Mamata Banerjee government, the truncated Jindal proposal will be a shot in the arm ahead of the general elections next year which she is widely expected to win with ease. Mamata had urged Sajjan Jindal at the Mumbai investors' meet in August 2013 to "do something" at Salboni and not to keep the land vacant.

In December last year, the Jindals gave up 294 acres bought directly from owners at the request of the Banerjee government soon after the steel and power project was officially put on hold. The move was widely seen as an attempt to assuage frustration at the local level for the delay in the project. For JSW, it was an insurance against a Singur-like situation and passport to keep the rest of the land idle for some more time.

The Mamata Banerjee government had snatched 997 acres meant for the Nano factory from Tata Motors which left the land idle for three years in May 2011. The Tatas shifted the near-ready plant to Sanand in Gujarat in October 2008 after facing violent agitation against land acquisition.

East on radar

JSW seems to be keen to make a beginning with the cement plant, fuelled by its ambition to become a national player in this sector and an opportunity in the eastern region, especially Bengal. "It is an important market and a growing one," Kulkarni said, adding demand may touch 14 million tonnes in this state alone, while Bihar and Jharkhand can add an equal amount.

Industry observers sounded upbeat about better volume from the eastern region in the future. "If infrastructure projects get going, demand will improve. Manufacturers have east on their radar for expansion," said a source.

ACC and Emami have long evinced their interest in setting up cement plants in Bengal. Reliance Cement is also scouting for opportunities to expand. OCL Cement, a flagship of Dalmia Cement, also has a unit near Salboni.

(Additional reporting by Pinak Ghosh)