The RBI on Friday took more steps to make the payment ecosystem more efficient and push digital transactions in the country.

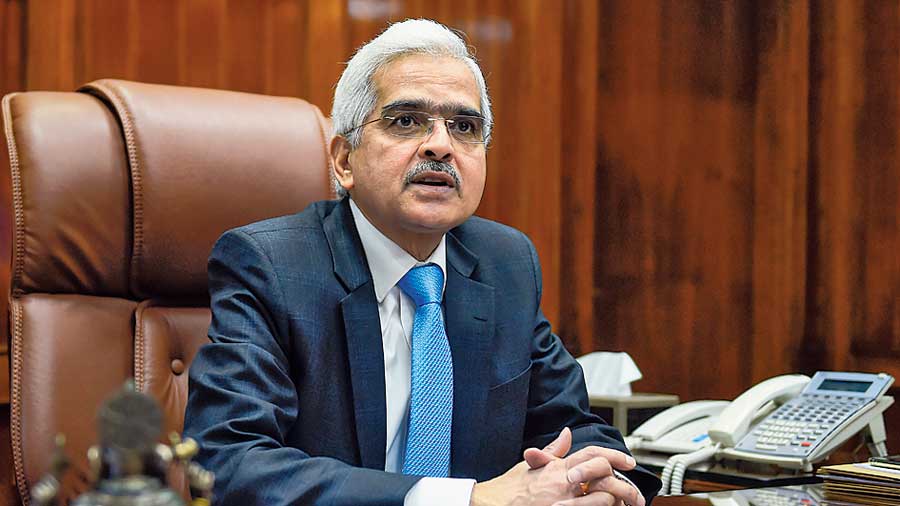

RBI governor Shaktikanta Das announced that real time gross settlement (RTGS) — an electronic fund transfer system used for large value transactions — will be made available round-the-clock within the next few days.

In December 2019, the National Electronic Funds Transfer (NEFT) system was made available on a 24x7x365 basis.

At present, RTGS is available to customers from 7am to 6pm on all working days of a week, except the second and fourth Saturdays of every month.

In another move, the RBI has enhanced the limit for contactless card transactions and e-mandates for recurring transactions through cards and UPI from Rs 2,000 to Rs 5,000 from January 1.

Contactless cards use near-field communication (NFC) technology and enable customers to make payments at terminals without swiping the card. Friday’s relaxation will mean customers need not enter PIN for transactions of up to Rs 5,000 if they are using a contactless card.

It may be recalled that in January this year, the RBI had told banks that they have to give card holders the facility of enabling or disabling their cards for various use like online or physical facility and it also give users the facility of setting transaction limits within the overall card limit

Contactless card transactions and e-mandates on cards (and UPI) for recurring transactions have enhanced customer convenience in general while benefitting from increased use of technology, the RBI said. It added that these are also well-suited to make payments in a safe and secure manner, especially during the current pandemic

In the last few months, there has been an exponential growth in contactless digital payments. This is because consumers are increasingly choosing to pay in a safe and hygienic way for their day to day needs. Mastercard welcomes the RBI’s decision to increase the limit from Rs 2000 to Rs 5000 without entering a PIN on contactless transactions through NFC cards…The RBI’s decision will further encourage consumers to use digital payments over cash and expedite India’s cash-to-digital journey’’, Vikas Saraogi, Vice President, Merchant Acceptance, South Asia, Mastercard said.

In order to deepen financial inclusion and protect customers by promoting financial literacy, a community led participatory approach through Centres for Financial Literacy (CFL) was implemented by the RBI through select banks and non-governmental organisations as a pilot project in 2017.

It is now proposed to expand the reach of the CFLs from 100 blocks currently to every block in the country in a phased manner by March 2024, he said.