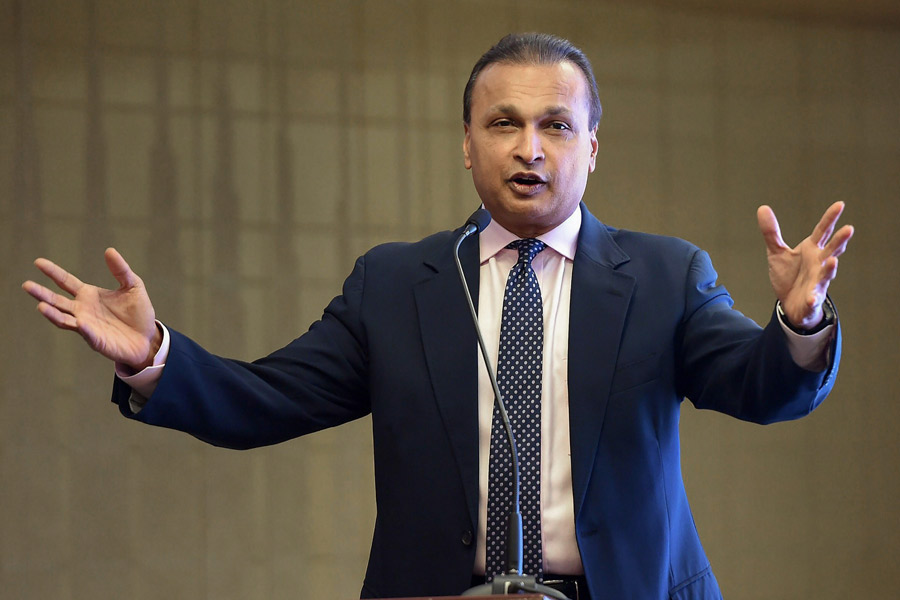

A loan fraud probe by the Enforcement Directorate against the Anil Ambani-led Reliance Anil Dhirubhai Ambani Group on Thursday urged Reliance Power to issue a clarification.

The group informed that the "recent action by the enforcement agency" will have "absolutely no impact on the business operations, financial performance, shareholders, employees or any other stakeholders of Reliance Power".

ED raided as many as 35 locations of companies linked to Anil Ambani on Thursday. This action came soon after the State Bank of India decided to classify Reliance Communications as a "fraud", eventually reporting its former director Anil Ambani to the Reserve Bank of India.

“It is clarified that Reliance Power is a separate and independent listed entity with no business or

financial linkage to RCOM or RHFL. RCOM is undergoing Corporate Insolvency Resolution Process as per the Insolvency and Bankruptcy Code, 2016 since over 6 years.” the company said in a media release.

Clarifying that Anil Ambani is "not on the Board of Reliance Power", the media release further stated, "RHFL has been fully resolved pursuant to the judgment of the Hon’ble Supreme Court of India.

Similar allegations as those set out in the media reports are sub-judice and pending before the Hon’ble Securities Appellate Tribunal, as per publicly available information.

Further, Mr. Anil D. Ambani is not on the Board of Reliance Power. Accordingly, any action taken against RCOM or RHFL has no bearing or impact on the governance, management, or operations of Reliance Power. Reliance Power continues to focus on its business plans and remains committed to creating value for all stakeholders.”

ED sources told PTI that they are probing allegations of illegal loan diversion of around Rs 3,000 crore from Yes Bank between 2017 and 2019.

Nexus of "bribe"

The ED has found that just before the loan was granted, Yes Bank promoters received money in their concerns, sources told news agency PTI.

The agency is investigating this nexus of "bribe" and the loan.

The federal agency is probing allegations of "gross violations" in Yes Bank loan approvals to Reliance Anil Ambani Group companies, such as back-dated credit approval memorandums (CAMs), investments proposed without any due diligence/credit analysis in violation of banks credit policy, the sources said.

The money laundering case stems from at least two CBI FIRs and reports shared by the National Housing Bank, SEBI, National Financial Reporting Authority (NFRA) and Bank of Baroda, they said.

SBI flags "fraud"

State Bank of India had recently decided to classify the loan account of telecom firm Reliance Communications as "fraud" and to report Ambani to the Reserve Bank of India (RBI).

Reliance Communications in a regulatory filing had said that it has received a letter dated June 23, 2025 from the State Bank of India (SBI) to this effect.