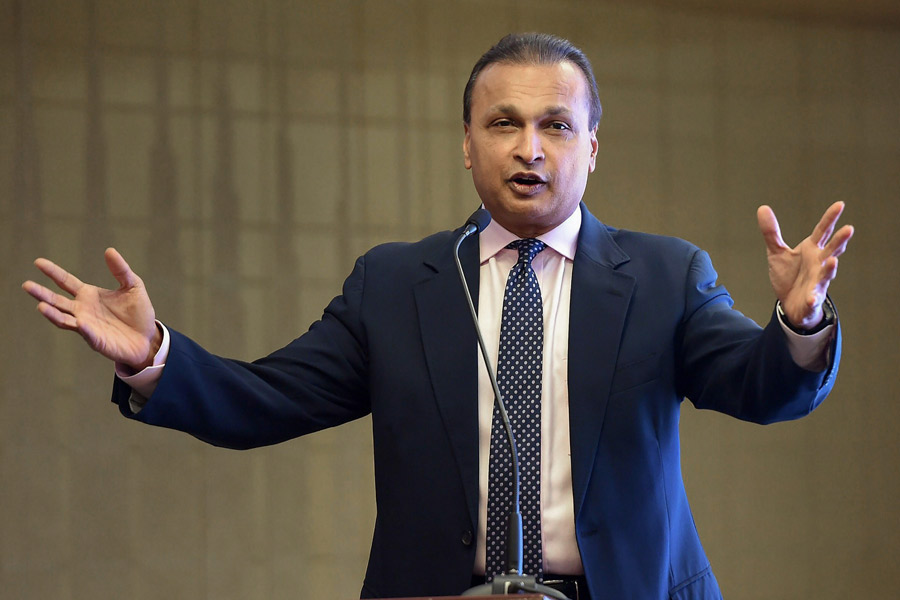

A money laundering investigation linked to an alleged bank loan fraud of Rs 3000 crore has led the Enforcement Directorate to conduct raids on companies linked to Anil Ambani, according to news agency PTI, quoting official sources.

On Thursday, more than 35 premises in Mumbai and Delhi of 50 companies and about 25 persons are being searched under the Prevention of Money Laundering Act (PMLA), sources told PTI.

ED sources said they are probing allegations of illegal loan diversion of around Rs 3,000 crore from Yes Bank between 2017 and 2019.

Nexus of "bribe"

The ED has found that just before the loan was granted, Yes Bank promoters received money in their concerns, the sources said.

The agency is investigating this nexus of "bribe" and the loan.

The federal agency is probing allegations of "gross violations" in Yes Bank loan approvals to Reliance Anil Ambani Group companies, such as back-dated credit approval memorandums (CAMs), investments proposed without any due diligence/credit analysis in violation of banks credit policy, the sources said.

The money laundering case stems from at least two CBI FIRs and reports shared by the National Housing Bank, SEBI, National Financial Reporting Authority (NFRA) and Bank of Baroda, they said.

SBI flags "fraud"

State Bank of India had recently decided to classify the loan account of telecom firm Reliance Communications as "fraud" and to report Ambani to the Reserve Bank of India (RBI).

Reliance Communications in a regulatory filing had said that it has received a letter dated June 23, 2025 from the State Bank of India (SBI) to this effect.

Reliance Communications is part of the group led by Anil Ambani, the brother of billionaire and one of Asia's richest men, Mukesh Ambani, who chairs the oil-to-telecoms conglomerate Reliance Industries. Reliance Communications disclosed in April that as of March 2025 it had a total debt of 404 billion rupees ($4.71 billion).

According to the filing, Reliance Communications and its subsidiaries received a total loan of Rs 31,580 crore from banks.

The Fraud Identification Committee of the bank has found deviation in utilization of the loans.

The letter marked to Reliance Communications and its erstwhile director Anil Ambani stated that SBI has decided to report the loan account of the company as "fraud" and to report the name of Anil Ambani to the RBI, as per the extant RBI guidelines, the filing said.

The bank said it gave Anil Ambani and the company several chances in the past two years to respond to the allegations of fraud in loans taken out in 2016 from Indian banks that were subsequently classified as bad or non-performing, but found their replies "insufficient".

(With PTI inputs)