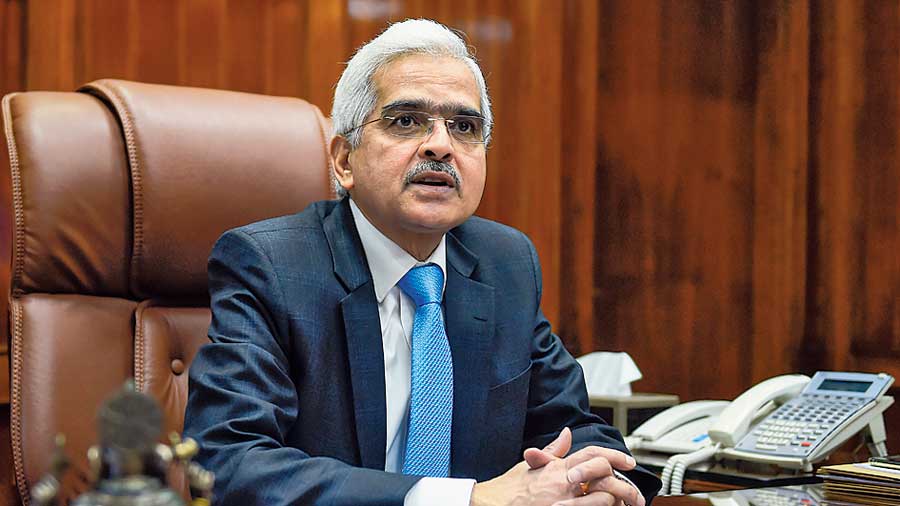

Reserve Bank of India governor Shaktikanta Das has said that a lot of imperfections have crept into the Indian bond market that the regulator needs to weed out before it can emerge as a vibrant alternative fundraising port of call for big businesses and entrepreneurs.

The Indian bond market, which is excessively skewed towards trading in government securities, shows a marked preference for only a “few benchmark tenors” even though the sovereign yield curve spans gilts with a maturity tenor of up to 40 years, Das said.

One of the biggest problems for the Indian bond market is that it is restricted to only a few players — largely domestic financial institutions. “Markets with a small number of participants tend to become ‘closed user clubs’ with predictable behavioral attitudes,” the RBI governor said while addressing the fourth annual day of the Foreign Exchange Dealers’ Association of India (FEDAI).

The governor said that this conservative, herd-like market behavior manifested itself in the “predominance of ‘buy and hold’ and ‘long-only’ investors”. The interest rate derivative market has also grown but “remained limited to one product — the Overnight Indexed Swap — and to a small set of participants”, Das said.

The RBI governor also flagged concerns about the manner in which the market was valuing the Indian rupee. “Domestic foreign exchange markets grew but so did the offshore markets, fragmenting the global market for the Indian rupee and impairing market efficiency,” Das said.

Dollar inflows

India has seen a massive inflow of dollars — a fact that the government has tom-tommed as investors’ confidence in the country’s economy and its equity and debt markets.

But the RBI governor made a nuanced observation about the dollar inflows. “Speculative flows in thin markets can create distortions. In deep markets, these very flows can add liquidity and make the markets more resilient. A calibrated opening up of the economy can supplement domestic savings and help finance growth and development,” he said.

The RBI governor’s comments

come at a time the Narendra Modi government is trying to develop a strong bond market from which the government and companies can access debt without overstraining the resources of the banking system.

According to Das, while the pace of financial market reforms has gathered momentum since the past three decades, the recent measures have centred around four major themes — liberalising financial markets and simplifying market regulation, internationalising financial markets, safeguarding the “buy side” – user protection and ensuring resilience and safety.

Capital account

On capital account convertibility, he said that the RBI will continue to approach this as a “process rather than an event” while taking note of the prevalent macroeconomic conditions. The RBI governor further disclosed that the country’s economy has recovered stronger than expected from the initial impact of the Covid-19 pandemic. He, however, added that here is a need to be watchful of demand sustainability after the end of festivities and that there are downside risks to growth across the world and also in India.

The Indian economy contracted 23.9 per cent in the first quarter of the financial year, and the RBI expects the economy to shrink 9.5 per cent in 2020-21.

“After witnessing a sharp contraction in the economy 23.9 per cent in the first quarter and a multi-speed normalisation of activity in the second quarter, the Indian economy has exhibited stronger than expected pick-up in momentum of recovery,” he observed.

He, however, reminded the participants that though the growth outlook has improved, downside risks to growth continue because of a recent surge in infections in parts of Europe and also in parts of India.

“We need to be watchful about the sustainability of demand after the festivals and a possible reassessment of market expectations surrounding the vaccine,” he said.