Mumbai, Sept. 19: Tata Sons today spent over Rs 3,200 crore to raise its stakes in Tata Motors, Tata Chemicals and Tata Global Beverages. Since June, the holding company of the $100billion conglomerate has put in almost Rs 7,000 crore to raise its ownership and untangle the cross-holdings within the group.

Data from the BSE where the trades were executed showed Tata Sons bought 38,767,541 shares of Tata Motors at an average price of Rs 421.44 per share, aggregating Rs 1,634 crore.

The shares are understood to be acquired under reverse book building, a process used for efficient price discovery.

Offers are collected from the share holders at various prices, which are above or equal to the floor price, and subsequently the offer price is determined.

It is not for the first time that Tata Sons is resorting to reverse book building. It had acquired five crore Tata Motors shares - about 1.73 per cent of the company's equity - in December, through this process.

It is learnt that Citigroup managed the purchase of Tata Motors' shares today. For the quarter ended June, the promoter group held 34.73 per cent in Tata Motors, of which Tata Sons' share was 31.60 per cent.

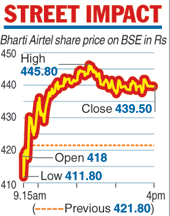

The transaction led to the shares of Tata Motors rising 4.58 per cent, or Rs 18.55, to end at Rs 423.90 on the BSE today.

Tata Global

Tata Sons also increased its stake in Tata Global Beverages by buying over 4.31 crore equity shares from Tata Chemicals at Rs 213.35 per share, aggregating over Rs 921 crore. In a regulatory filing, Tata Chemicals said it sold 4,31,75,140 equity shares of Tata Global Beverages to Tata Sons for Rs 213.35 per share.

As on the quarter ended June 2017, Tata Chemicals held 7.10 per cent stake in Tata Global Beverages, while Tata Sons had a 23.5 per cent stake.

Similarly, Tata Sons also acquired 10,480,000 shares of Tata Chemicals from Tata Global Beverages at a price of Rs 642.55, for Rs 673 crore.

Shares of both Tata Global Beverages and Tata Chemicals also ended in the green, with gains of 2.65 per cent and 14.40 per cent, respectively, on the BSE.

In all, the group holding firm today invested Rs 3,228 crore to fortify its stake. Under its new chairman N. Chandrasekaran, Tata Sons had been systematically reducing its cross-holdings within the group.

In June, Tata Sons had spent Rs 3,783 crore in more than 8 crore Tata Motors shares from Tata Steel. Sebi norms say a promoter can raise its holding by up to five per cent in a fiscal year, through the creeping acquisition route.