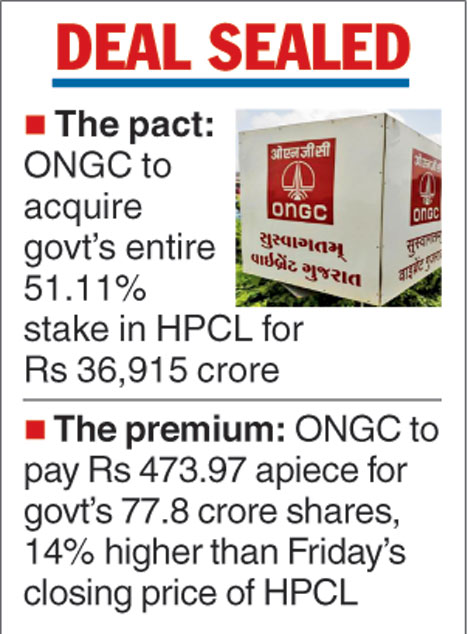

Mumbai: Oil and Natural Gas Corporation Ltd (ONGC) on Saturday announced the acquisition of Union government's entire 51.11 per cent stake in oil refiner HPCL for Rs 36,915 crore.

ONGC will pay Rs 473.97 per share for 77.8 crore shares of the government in Hindustan Petroleum Corp Ltd (HPCL), the company said in a stock exchange filing.

The price it is paying is 14 per cent higher than Friday's closing price of HPCL and over 10 per cent of the 60-day weighted average of the scrip.

The transaction, which will help the government top its annual sell-off (divestment) target for the first time ever, has been executed through an off-market deal.

When the government started talks for selling a controlling stake in the country's third largest oil refining and fuel marketing company, it sought to garner about Rs 1 lakh crore on grounds that an open sale would fetch no less than that. However, what ONGC is paying is far less.

ONGC's own adviser EY had valued HPCL at Rs 475 a share plus a premium for getting the controlling stake, sources privy to the negotiations said. The outside advice the company took from Citi put the price at Rs 500 per share.

ONGC negotiated hard and brought down the acquisition price, they said and added that the company would do short-term borrowing to fund the acquisition that would be an all-cash deal to be completed by the end of the month. The company also has cash reserves of about Rs 12,000 crore.

According to sources, ONGC has already taken its board's approval to raise the borrowing limit to Rs 35,000 crore from the previously approved Rs 25,000 crore.

It also has loan commitments from domestic and foreign lenders, totalling roughly double the acquisition price and the company would draw from them to make the payments in next one week, they said.

Based on Friday's closing price of Rs 416.55, HPCL has a market capitalisation of about Rs 63,475 crore. At this price, the government's 51.11 per cent stake is worth Rs 32,442 crore.

"The Government of India has entered into an agreement with ONGC today for the strategic sale of its 51.11 per cent equity in HPCL at a consideration of Rs 36,915 crore," the finance ministry tweeted.

The ministry reasoned the merger to the February 2016 review called by Prime Minister Narendra Modi where he "underlined the need of efficient management of government investments in central public sector enterprises (CPSEs)".

"Accordingly, as part of the investment management strategy, the Government of India decided to explore possibilities of consolidation, mergers and acquisitions within the CPSE space. An announcement in this regard was also made by the finance minister in his budget speech of 2017-18," it said.

In line with the finance minister's budget announcement, ONGC proposed to acquire the government's existing 51.11 per cent equity shareholding in HPCL.

The Union Cabinet, in its meeting held on July 19 last year, gave an "in-principle" approval to the said proposal and decided to set up an alternative mechanism under Jaitley to decide on the price, timing and the terms and conditions of the strategic sale.

"The alternative mechanism under the chairmanship of the finance minister in its meeting today approved the price bid of ONGC and the terms and conditions of the sale," it said.

Through this acquisition, ONGC will become India's first vertically integrated "oil major", having presence across the entire value chain. The integrated entity will have the advantage of having enhanced capacity to bear higher risks and take higher investment decisions.

In this process, ONGC has acquired significant mid-stream and downstream capacity and will attain economies of scale at various levels of operations.

During 2016-17, HPCL clocked a turnover of Rs 2,13,489 crore and a profit of Rs 6,502 crore. It sells around 35.2 million tonnes of petroleum products and has a market share of about 21 per cent. It has refineries in Mumbai and Visakhapatnam and a joint venture refinery in Bhatinda.