Mumbai: Market watchers remain divided over how 2018 will pan out for equities - the optimists expecting the party to continue and others advising caution to focus only on select stocks.

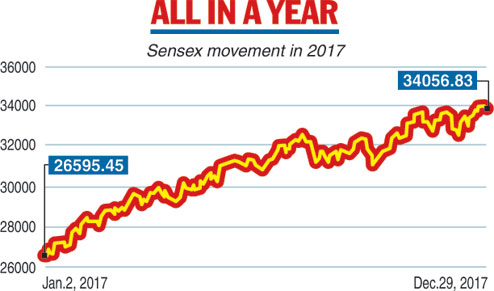

This comes after a pleasing 2017 had proved the Cassandras wrong. While the benchmark indices rose 28 per cent, the gains in the mid-cap and small-cap universes were even more as the markets braved patchy economic growth and tepid corporate results.

Besides, private sector capex remained lifeless even as demonetisation and the GST created a churn. Yet, with the benchmark indices remaining in the record zone because of strong fund flows, valuation concerns remain.

Experts however, remain optimistic. They point out that one of the major factors that will drive equity prices is the revival in corporate growth that could happen during the year. The first signs should be seen in the upcoming third quarter results where firms are likely to report good numbers because of the base effect. It may be recalled that in the same period last year, corporate India's performance was affected by demonetisation.

"The year (2018) will be a good year for the markets. While shocks like the GST and demonetisation are behind us, earnings will be more stronger than the previous year. This may lead to multiple upgrades in different sectors. The year will present investors with pockets of opportunities in companies and sectors where they can pick and choose. Some of the sectors that will do well include NBFCs, auto ancillaries and consumer oriented sectors such as retail," Yogesh Nagaonkar, fund manager, Bonanza PMS, told The Telegraph.

Optimism is also high on interest rates and weather. Bank of America Merrill Lynch said in a recent note the Reserve Bank of India (RBI) could cut the policy rate by 25 basis points in April as inflation would cool down to around 4.5 per cent in 2018. It also referred to the Australian weather bureau predicting La Nina (which helps South West monsoon) that could contain inflationary pressures.

Crude concern

However, there are certain developments that should warrant caution. Rising crude oil prices have already began to spook analysts.

The fear is that apart from its effect on inflation, it could also have an adverse impact on the government's finances as the Centre may be forced to go for an excise cut in petrol and diesel. Bond yields have also hardened in recent times. Yet another key event is the upcoming budget.