|

Mumbai, March 8: The government today raised over Rs 310 crore from a 12.5 per cent stake sale in Rashtriya Chemicals & Fertilisers (RCF).

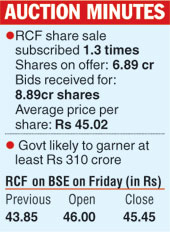

The auction got bids of over 7.94 crore shares, a demand of 1.3 times against an offer of over 6.89 crore, according to data available from the stock exchanges. However, the offer managed full subscription only minutes before the markets closed.

The indicative price, which is the average price of all valid bids, was Rs 45.02 a share. At this price, the government will garner at least Rs 310 crore.

The government had fixed the floor price at Rs 45 apiece, which is at a 2.6 per cent premium to yesterday’s close of Rs 43.85 on the Bombay Stock Exchange (BSE).

Shares of RCF today closed at Rs 45.40, up 3.53 per cent from its previous close on the BSE.

The government holds a 92.5 per cent in the fertiliser and chemicals company.

The RCF stake sale will enable the government to come closer to the divestment target of Rs 30,000 crore for the current fiscal. It has so far raised Rs 21,500 crore through stake sales in public sector units such as Oil India, NTPC, NMDC and Hindustan Copper Ltd. Stake sales in Nalco, SAIL and MMTC are in the pipeline for the current fiscal.

Various brokerages had asked investors to subscribe to the RCF offer for sale.

“We recommend investors to subscribe to the RCF issue as it is fairly valued and the successful completion of projects in the pipeline will provide upside to the stock in the future,” Angel Broking had said in a note prior to its opening.

According to stock exchange data, most of the bids came in the category where no upfront margin was required.

Bids of around 6.68 crore shares came with zero per cent margin where they cannot be revised.

Bids of over 2.21 crore shares were with 100 per cent margin. Here, the bidders can withdraw if they want.

RCF is the fourth largest producer of urea — sold under the brand name Ujjwala — with a market share of 10.7 per cent and a capacity of around 23 lakh tonnes.

The company has two operating units at Trombay and Thal in Maharashtra.