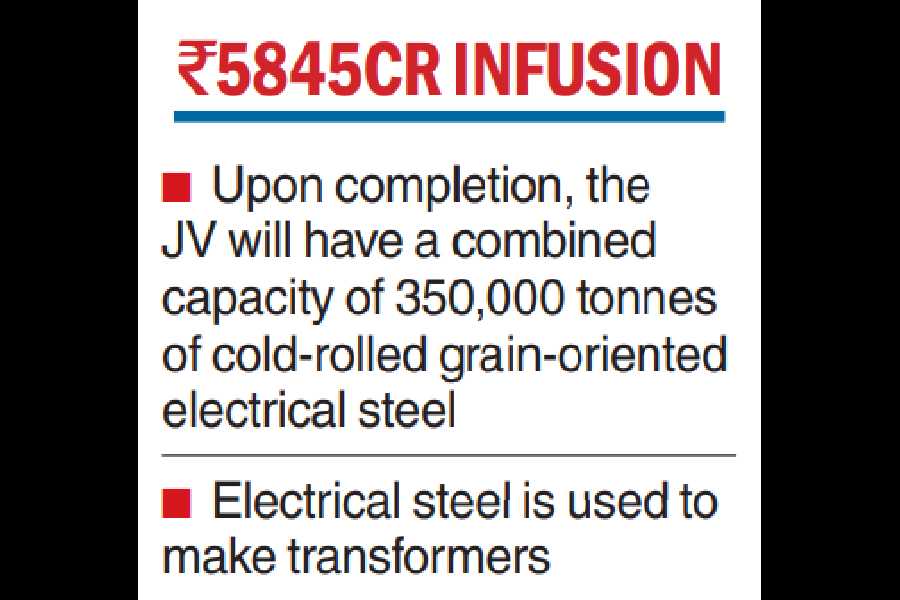

JSW Steel and its Japanese partner, JFE Steel Corporation, have raised their bet on electrical steels, announcing an additional 238,000 tonnes of capacity expansion across two sites in India, entailing a fresh investment of ₹5,845 crore.

Upon completion, the joint venture between JSW and JFE, will have a combined capacity of 350,000 tonnes of cold rolled grain-oriented electrical steel (GOES), used to make transformers, in India. The additional investments come on top of plans earlier unveiled by the JV, which included a greenfield unit in Vijaynagar in Karnataka and acquisition of Thyssenkrupp’s Nasik plant.

As part of the plan, the Nasik plant will see a five-fold increase in capacity to 250,000 tonnes by 2028, while the Vijayanagar unit, which is under construction, will now have a 100,000-tonne capacity, instead of 62,000 tonnes envisaged earlier. The Nasik unit will involve a capex of ₹4,300 crore, while the Karnataka plant is going to witness an additional investment of ₹1,545 crore.

The combined capital investment by the JV in CRGO steel in India, announced on Monday and planned earlier, including the Thyssen unit acquisition cost, will total ₹15,560 crore, JSW Steel said.

Commenting on the development, Jayant Acharya, joint managing director & CEO, JSW Steel, said: “India’s green energy transformation, decarbonisation and digital infrastructure development are triggering large demand for high-grade electrical steel.”

“Our GOES investment is a critical step in enabling import substitution, supporting India’s energy transition goals, and delivering high-efficiency electrical steel solutions to the domestic and global markets. This investment with our long-standing partner JFE Steel reaffirms our commitment to building strategic and future-ready steel capabilities that serve both national and global priorities.”

JSW Cement IPO

JSW Cement has priced its $412.72-million initial public offering between ₹139 and ₹147, valuing the 17-year-old company at ₹20,000 crore at the upper end of the price band.

The cement arm of the JSW conglomerate first filed to go public last August, but Sebi put it on ice for four months without disclosing a reason and approved the filing only in January this year. Proceeds from the fresh issue is planned to fund a factory in Rajasthan, a state rich in cement’s key raw material, limestone.