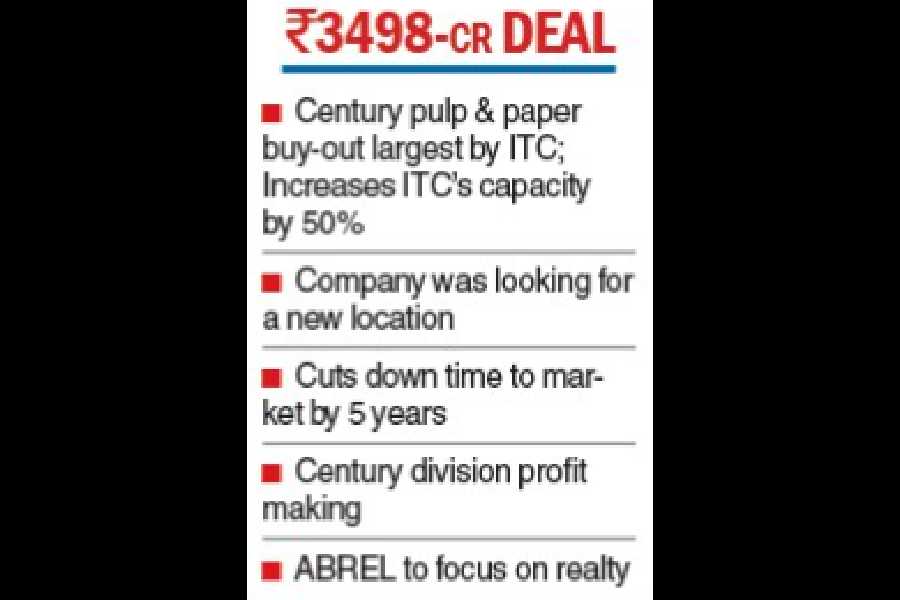

ITC Ltd is set to acquire the pulp and paper division of Aditya Birla Real Estate Ltd (formerly Century Textiles & Industries) for ₹3,498 crore, making it the largest acquisition ever undertaken by the Calcutta-based conglomerate.

The deal, which is expected to be concluded within six months, subject to shareholders’ and regulatory approvals, will consolidate ITC’s presence in the domestic paperboard and speciality paper segment and push up its installed capacity by 50 per cent.

Acquisition of Sunrise Foods in 2020 for ₹2,150 crore was the largest by ITC so far, which in recent years has not shied away from buyouts to grow.

Established in 1984 at Lalkuan in Nainital, Uttarakhand, the Century Pulp and Paper (CPP) unit with a 4.8-lakh-tonne capacity and a strong presence in north India is going to complement ITC’s manufacturing bases in the southern market.

Describing CPP as a one-of-its-kind asset, ITC said the acquisition would immediately add to ITC’s scale without adding to the domestic capacity and be EPS accretive in the first full year of operations.

With a domestic industry size of 23 million tonnes per annum and growing by 6-7 per cent, incremental demand for paper and paperboard is going up by 1 mt a year. ITC’s capacity stands now at 1 mt with 4 manufacturing sites — three in the South and one in Bengal — recording ₹8,344 crore in revenues in FY24. In comparison, ABREL’s CPP division posted a revenue of ₹3,375 crore in FY24.

Pointing out that the transaction will strengthen the market standing of ITC’s paperboards and specialty papers business B. Sumant, executive director, ITC Limited, said, “The acquisition aligns with the company’s strategy of driving the next horizon of growth in the paperboards and specialty papers business by expanding capacity at a new location considering that the existing facilities are already saturated.”

For ABREL, the divestment is expected to sharpen the company’s focus in the real estate business.

“The divestment is a strategic portfolio choice and unlocks value for the shareholders of the company,” R.K. Dalmia, managing director of ABREL, said in a statement.

Time to market

In a presentation to the bourses, ITC said it would target a 30-40 per cent increase in EBIDTA/tonne post two full years of operations through value unlocking interventions such as mix enrichment and pulp import substitution and capacity debottlenecking.

Moreover, it expects high teens return on capital employed (RoCE) on the investment in the medium term.

With CPP’s acquisition, ITC will also be able to add capacity without building a greenfield unit which usually takes 5-6 years. The faster time-to-market route would also dispense with teething troubles of finding suitable raw material linkages and approvals required for the same.

Despite paying big bucks for the buyout, ITC said that it would be within the guard rail of the capital allocation framework of the company. It plans to calibrate capex at the existing facilities post CPP takeover.

ITC’s paper, paperboard and packaging segment is expected to continue to generate a ‘robust free cash flow’, it said in the presentation, adding that the division generated ₹4,000 crore FCF between FY20-FY24.

However, the performance of the segment has been impacted in recent months due to a sharp increase in low-priced imports and a surge in domestic wood prices.