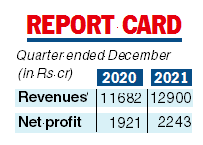

Hindustan Unilever Ltd (HUL) on Thursday met estimates when it reported a 17 per cent rise in standalone net profit for the third quarter ended December 31, 2021. Net profit of the FMCG giant rose to Rs 2,243 crore compared with Rs 1,921 crore in the same period of the previous year.

However, volume growth fell to 2 per cent compared with 4 per cent in the July-September quarter. Companies such as HUL have faced a surge in raw material prices which has forced them to take measured price hikes. Analysts say the higher product prices have resulted in the moderation of demand.

The quarter saw sales at Rs 12,900 crore compared with Rs 11,682 crore a year-ago . Sanjiv Mehta, chairman & managing director, HUL, said the operating environment remained challenging.

The company warned FMCG market growth is slowing down and volumes declining because of inflation. Commodity prices also remain volatile and elevated and have risen on a sequential basis in the current quarter. HUL will resort to calibrated pricing actions and cost saving programmes to protect margins.

Fiscal deficit

The government should not be in a rush to bring down the fiscal deficit and must continue with measures to put more money in the hands of consumers, especially in rural areas where FMCG volume growth has turned negative, Mehta said.

With “unprecedented” inflation of commodity prices impacting rural consumption, all the relief provided by the government in the last few years for the rural consumers through schemes like such as MGNREGA and free food supply “ought to be extended in the next fiscal...” he said.

Asian Paints

Asian Paints Ltd on Thursday reported an 18.5 per cent decline in consolidated net profit to Rs 1,031.29 crore for the third quarter ended December as inflationary trends in raw material prices continued to impact the company's gross margins across businesses.

The company had posted a net profit of Rs 1,265.35 crore during the October-December quarter of the previous fiscal.

Its revenue from operations jumped 25.61 per cent to Rs 8,527.24 crore during the quarter under review. The same stood at Rs 6,788.47 crore in the corresponding period of the previous fiscal.

Asian Paints managing director & CEO Amit Syngle said the steep and unprecedented inflationary trend in raw material prices continued to impact the gross margins across businesses this quarter.

“Substantial price increases have been taken in November and December to mitigate this inflation impact, improving the margins on a sequential basis”.