India may have to go back to West Asia and scout for deals in Latin America and West Africa for oil supplies after the US hit two of Russia’s top producers with punitive sanctions, experts say.

The pivot, which will be fraught with near term challenges over financing and logistics, however, may prove to be a blessing in disguise for the Modi government as India’s import of Russian crude is set to fall dramatically, meeting a key demand of the Trump administration and facilitating a favourable trade deal with the US.

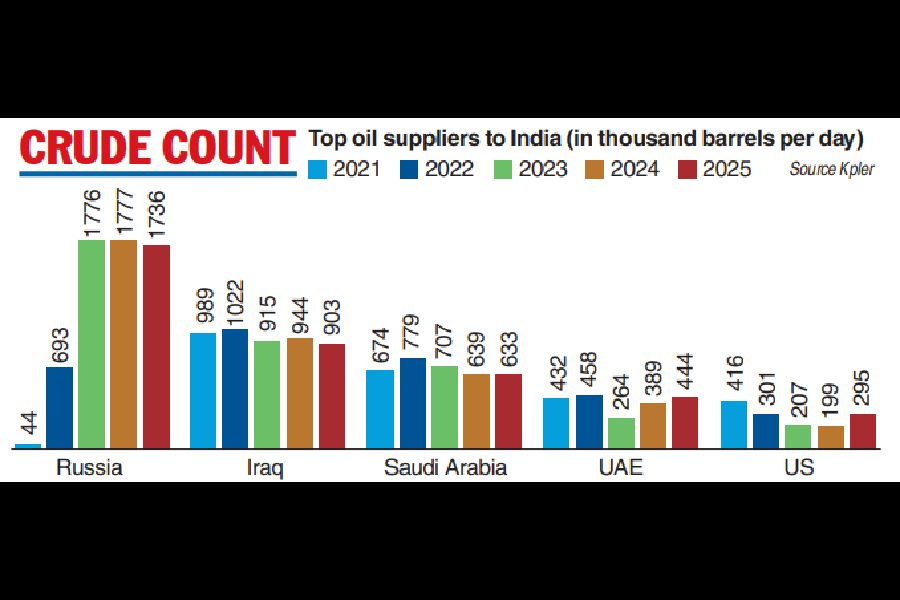

West Asia used to traditionally be India’s major suppliers before the start of the war in Ukraine. India’s import from Russia jumped from 1.1 per cent in 2021 to 37.7 per cent in 2024. It is still hovering at 30-34 per cent now.

Even as the flow of Russian barrels from the two sanctioned players, Rosneft and Lukoil, can continue till November 21, Indian refiners are already looking at West Asia, aligning themselves with the Modi government’s desire to cut back energy ties with Kremlin in order to please Washington.

“To compensate for reduced direct Russian inflows, Indian refiners are expected to increase procurement from West Asia, Brazil, Latin America, West Africa, Canada and the United States. However, higher freight costs could erode arbitrage opportunities and limit large-scale substitution,” Sumit Ritolia, lead research analyst with market intelligence firm Kpler, said.

India already has term contracts or spot mechanisms and logistics in place for most of these regions, so diversification will be technically feasible, though not cost-neutral. Moreover, most of the refineries in India — Jamnagar, MRPL, Panipat, Kochi, Paradip and HMEL — can handle a wide range of crude grades, from heavier Basra Medium, Maya, Castillata and Vasconia to lighter WTI, Agbami and Arab Extra Light.

Kpler’s Ritolia suggested that Russian oil itself is not sanctioned, it is the two producers who got blacklisted, leaving other producers in the clear. Ajay Srivastava of Global Trade Research Institute (GTRI) pointed out that Rosneft and Lukoil account for 57 per cent, leaving the other 43 per cent technically unsanctioned.

GTRI founder Ajay Srivastava argued the flexibility of switching to other non-sanctioned Russian producers may not be feasible, if it wants to say yes to Trump’s demand, to get reprieve from the 25 per cent penalty US tariff.

“India now faces a pivotal question: Would the 25 per cent tariff be lifted if New Delhi stopped buying from Rosneft and Lukoil — or must it abandon all Russian oil to qualify for relief?” Srivastava asked.

Brokerage firm Nomura Holding Inc argued that India’s shift away from discounted Russian crude should be more than offset by gains from likely lower US tariffs.