Government bond prices may come under pressure as the much awaited inclusion of India in a global bond index has reportedly been delayed to next year.

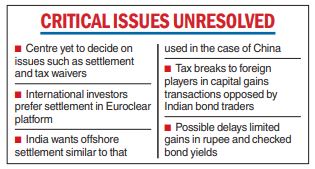

The central government is yet to address key issues that include changes in its tax policies, which is a factor behind the delay.

Optimism that India will be included in an index such as JP Morgan’s GBI-EM Global Diversified index soared recently following the exclusion of Russia from the index.

It has led to inflows from foreign investors into government securities resulting in yields — which are inversely related to prices — on the benchmark 10-year security dropping to 7.19 per cent in late August from 7.42 per cent in early July.

While FTSE Russell and JP Morgan were expected to announce their index reviews in the coming weeks, Reuters reported on Tuesday that government bonds will likely only be included in the JPMorgan emerging market global index early next year as the centre still needs to address various ``operational issues’’.

These include where bond trading should be settled and tax reliefs. While global investors prefer international settlement platforms such as Euroclear, India wants to settle bonds onshore such as China.

None of the participating nations in Euroclear imposes a capital gains tax on bond transactions. The central government is not keen on granting any waiver to overseas investors.

There have been opposition from groups close to the government to grant such a relief to overseas investors as domestic investors have to pay capital gains tax.

Last month, analysts at Goldman Sachs said the inclusion of India in a global bond index would lead to passive inflows of about $30 billion.

Yields on the benchmark 10-year paper on Tuesday closed at 7.29 per cent against the previous close of 7.35 per cent amid expectations that the Reserve Bank of India (RBI) may announce open market operations (OMO) on Friday to support the market. Observers cautioned that the non-inclusion in a global bond index could hurt sentiment and may put pressure on G-Sec prices.

The news limited the rupee’s gains against the dollar at the inter-bank forex markets on Tuesday.

After posting losses for four straight sessions, the domestic unit ended at 81.58 against the greenback against the previous close of 81.62.

The US currency softened globally with Dollar Index falling to 113.33 against the last finish of 114.10. The rupee’s gains also came on the back of weak crude prices with the benchmark Brent crude trading at around $84 a barrel.