Mumbai: Infrastructure lender IFCI has sold part of its stake in the National Stock Exchange (NSE) in a transaction that values the bourse at over Rs 46,000 crore.

Mumbai: Infrastructure lender IFCI has sold part of its stake in the National Stock Exchange (NSE) in a transaction that values the bourse at over Rs 46,000 crore.

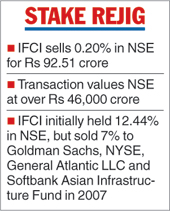

In a communication to the bourses, the company said it had sold a 0.20 per cent stake in the bourse for Rs 92.51 crore. The transaction values the NSE at Rs 46,255 crore.

"The company has made a partial divestment to the extent of 10 lakh equity shares of the NSE at Rs 925.10 per share,'' IFCI said. It, however, did not disclose the identity of the buyer.

At a board meeting of the lender in September last year, a proposal was cleared for the sale of a 0.86 per cent stake in the NSE to one or more interested buyers in part or full.

According to the NSE website, as on September 30, 2017, the IFCI held 3.05 per cent in the stock exchange.

IFCI initially held a 12.44 per cent stake in the NSE, but sold 7 per cent to the Goldman Sachs group, the NYSE group, General Atlantic LLC and Softbank Asian Infrastructure Fund in 2007. IFCI has been selling stake in the NSE on various occasions.

The NSE's other major shareholders include LIC (12.51 per cent), investment firms SAIF II SE Investments Mauritius (5 per cent) and Tiger Global Five Holdings (3 per cent).

While the NSE had filed papers with Sebi for an initial public offering in December 2016, this has been delayed because of the co-location issue.

Vikram Limaye, the new chief executive of the NSE, has said his priority was to get the co-location issue sorted out and that the IPO would come after that.

NMDC offer

Institutional investors put in bids worth Rs 976 crore on Tuesday to buy a part of the government's stake in state-owned miner NMDC.

The government had originally planned to sell a 1.5 per cent stake, with a green-shoe option to retain an equal quantum. Based on the response from institutional buyers, however, it has decided keep the issue size at 2.52 per cent.