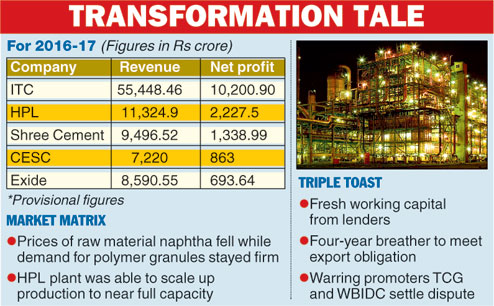

Calcutta, Aug. 27: Purnendu Chatterjee's Haldia Petrochemicals has emerged as the second most profitable private sector company out of Bengal after scripting a remarkable turnaround of its business.

The company is set to declare an over Rs 2,200-crore profit at the net level for 2017-18, trailing only the behemoth ITC, but racing past Shree Cement, CESC and Exide.

High tolling margin and healthy capacity utilisation turned HPL - which was staring at bankruptcy and closure two years back - net worth positive at the end of the last fiscal.

Moreover, the once debt-laden company, which was always on tenterhooks fearing default on payment obligations to lenders, has become almost debt-free on a net debt basis and has also returned some of the cash due to financial institutions.

The phoenix-like transformation was possible largely because of good tidings in the petrochemicals market.

Prices of naphtha, the basic raw material for Haldia Petrochem that produces polymers used in the plastic industry, fell in tandem with the fall in crude rates in the global market. However, demand for polymer granules remained buoyant because of a latent demand from application industries.

Second, the company that was operating at nearly half of its rated capacity because it did not have enough working capital to buy naphtha and had to shut down the plant for nearly seven months on the pretext of maintenance from July 2014 to February 2015, managed to scale up utilisation to near full capacity.

"HPL could take full benefit of the up-cycle because it ran the plant full throttle," a source said.

HPL suffered Rs 1143.6 crore loss in 2014-15 and earned Rs 1423.7 crore in profit in 2015-16.

External aid

While the market played an important role, there are at least three crucial developments during past two years that helped turn HPL's fortunes.

First, the SBI-led lenders offered fresh working capital to restart the plant after private promoter The Chatterjee Group agreed to provide Rs 100 crore as margin funding.

Later that year, the Centre allowed a four-year breather to HPL to meet its export obligation against an advance licence obtained for importing duty free naphtha.

The Directorate-General of Foreign Trade had imposed a penalty of Rs 3,171 crore for failing to meet the obligation but the company was given time to do so. By the end of the last fiscal, HPL had managed to reduce the obligation by a third already.

At the end of the year, the warring promoters of HPL -TCG and the West Bengal Industrial Development Corporation - buried the hatchet. Following a share purchase agreement, TCG bought 26 crore shares at Rs 25.10, paying Rs 653 crore to the state government. Following this, the management of the company was conclusively taken up by TCG.

Looking ahead

Even as HPL is said to be making a profit at a fast clip this year too, the Chatterjee-led management is busy making plans to make the company resilient during a downturn by investing in value-added chemical downstream projects. It is already setting up a butene-1 and pygas desulfurisation project at an estimated cost of Rs 400 crore. However, many more downstream projects are in the pipeline.

Meanwhile, TCG has also proposed to build a refinery at Haldia at an estimated investment of Rs 20,000 crore and has sought a 1,500-acre land from the state at Haldia.

"The idea is to ensure control over raw material naphtha from the refinery in the upstream and increase the pie of value added products in the downstream," an expert from the petrochemicals industry explained.