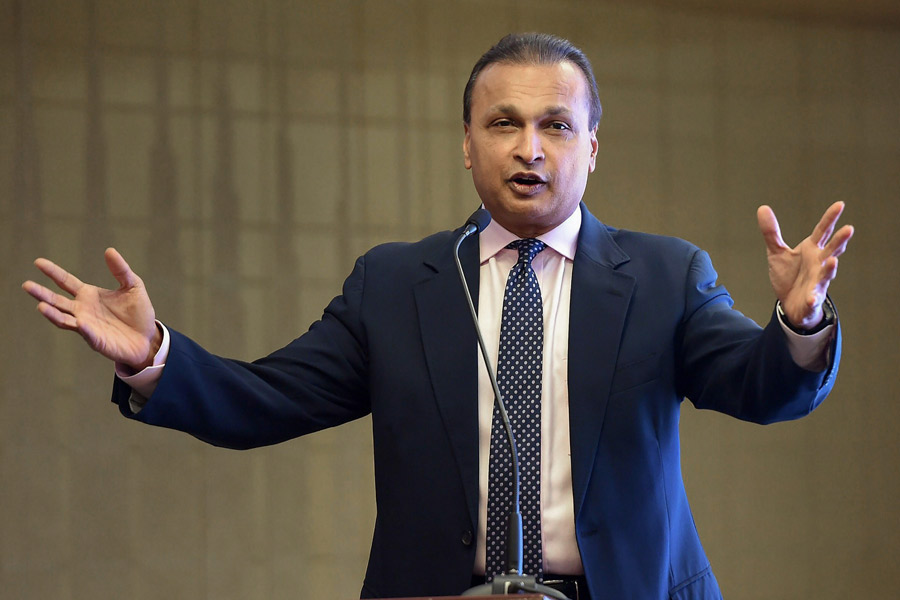

After the State Bank of India, Bank of India has classified the loan account of insolvent Reliance Communications as fraudulent and named its former director, tycoon Anil Ambani, citing alleged fund diversion in 2016, according to a regulatory filing.

State-owned Bank of India granted a Rs 700-crore loan in August 2016 to Reliance Communications for its ongoing capital and operational expenditure and repayment of existing liabilities. Half of the sanctioned amount disbursed in October 2016 was invested in a fixed deposit, which was not permitted as per the sanction letter, according to the bank's letter that RCom disclosed in a stock exchange filing.

RCom said it has on August 22 received a letter from Bank of India dated August 8 stating the bank's decision "to classify the loan accounts of the company, Anil Dhirajlal Ambani (promoter and erstwhile director of the company), and Manjari Ashok Kacker (erstwhile director of the company), as Fraud".

Previously, State Bank of India (SBI) had done the same in June this year, alleging misappropriation of bank funds by entering into transactions that violated the terms of the loans.

Following a complaint by SBI, the Central Bureau of Investigation (CBI) on Saturday searched premises linked to Reliance Communications and Ambani's residence.

CBI said it has registered a complaint after the State Bank of India claimed a loss of Rs 2,929.05 crore, resulting from the alleged misappropriation by Reliance Communications and Ambani, the younger sibling of Asia's richest man Mukesh Ambani.

Anil Ambani's spokesperson, in a statement, "strongly denied all allegations and charges" and said he "will duly defend himself".

"The complaint filed by SBI pertains to matters dating back more than 10 years. At the relevant time, Ambani was a non-executive director of the company, with no involvement in the day-to-day management," the spokesperson said.

"It is pertinent to note that SBI, by its own order, has already withdrawn proceedings against five other non-executive directors. Despite this, Ambani has been selectively singled out." The spokesperson further claimed that the Bank of India classification of RCom's account was "without following the principles of natural justice".

"While a show cause notice was issued to Ambani, the requisite documents were not furnished to him. Bank of India further deprived him of the opportunity of a personal hearing in the matter. These actions are contrary to the RBI regulations issued in July 2024, as well as to well-established law and the judgments of the Supreme Court and the Bombay High Court," the spokesperson said.

"Bank of India, after issuing a Show Cause Notice to 13 directors and key managerial personnel (KMPs) of RCom, unilaterally withdrew the same against all others. However, it selectively continued the proceedings against Anil D Ambani," as per the statement.

Reliance Communications in the latest filing said its subsidiary Reliance Telecom Ltd, too, has received a letter from Bank of India conveying the lender's decision to classify the loan accounts of the company, Grace Thomas (erstwhile director of RTL and present director of the company) and certain other persons as 'Fraud'.

Under banking laws, once an account is declared fraudulent, it must be referred to enforcement agencies for criminal action, and the borrower is barred from accessing fresh finance from banks and regulated institutions for five years.

Bank of India, in the letter disclosed in the Reliance Communications filing, said RCom had turned NPA on June 30, 2017, with an outstanding of Rs 724.78 crore.

"The Bank has been following up with the borrowers and guarantors for repayment of dues; however, they have failed and neglected to make repayment of the dues." Reliance Communications had in April disclosed that its total debt stood at Rs 40,400 crore in March.

Following unpaid loans, the company was admitted for insolvency and bankruptcy proceedings.

Reliance Communications is being managed under the supervision of a committee of creditors, led by SBI and overseen by a resolution professional. The matter remains sub judice, pending before the NCLT and other judicial forums, including the Supreme Court, for the past six years.