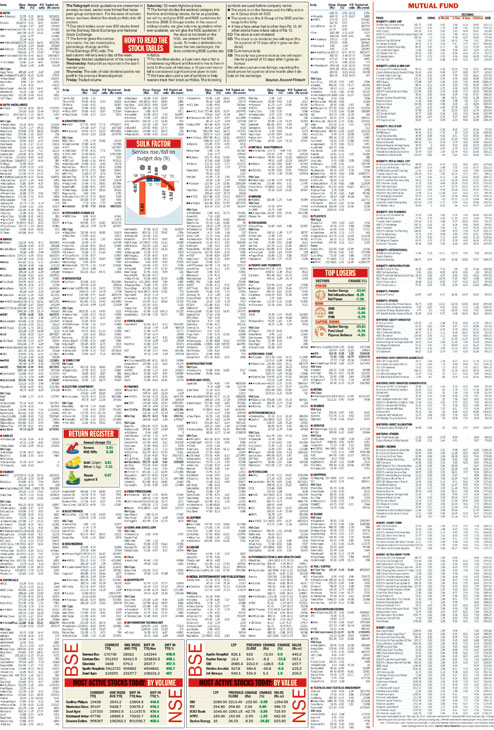

The Telegraph stock quotations are presented in an easy-to-read, sector-wise format that helps peer group comparison. For the sake of convenience, we have divided the stock portfolio into 46 sectors.

Our stock tables cover over 800 stocks listed on the Bombay Stock Exchange and National Stock Exchange.

The format gives the company’s name, the last traded price, percentage change and the Price/Earnings (P/E) ratio. The last column will vary every day of the week.

Tuesday: Market capitalisation of the company.

Wednesday: Net profit as reported in the last financial year.

Thursday: The ratio of total dividend paid to net profit in the previous financial period.

Friday: Traded volume.

Saturday: 52-week high/low prices.

The format divides the sectoral category into frontline and midcap stocks. As far as possible, we will try and give BSE and NSE quotations for frontline (BSE A Group) stocks. In the case of midcap stocks, we give only one quotation: wherever available, we will give the NSE quotation; if the stock is not listed on the NSE, we present the BSE quote. To make a distinction between the two exchanges, the lines containing BSE quotes are in italics.

For frontline stocks, a 5 per cent rise or fall is considered significant and the entire line is then in bold. In the case of midcaps, a 10 per cent rise or fall is considered significant and given in bold.

We have also used a set of symbols to help readers track their stock portfolios. The following symbols are used before company name:

The stock is on the Sensex and the Nifty and is an A Group stock on BSE

The stock is on the A Group of the BSE and belongs to the Nifty

It has a face value that is other than Rs 10. All other stocks have a face value of Rs 10.

CD The stock is cum-dividend

XD The stock is ex-dividend (we will report this for a period of 15 days after it goes ex-dividend)

CB Cum-bonus scrip

XB The scrip has gone ex-bonus (we will report this for a period of 15 days after it goes ex-bonus)

We will also capture new listings, reporting the stock prices for a period of one month after it debuts on the exchange.

|