New Delhi, Jan 19: The Centre and states have decided to water down the penal provision of GST to ensure that tax evasion up to Rs 2 crore is a bailable offence.

"In case of offences where the amount does not exceed Rs 2 crore, the person arrested for violation of GST laws will be entitled to bail," an official privy to the GST Council's last meeting said.

The penal provisions in GST will be less onerous than the provision in the Indian Penal Code (IPC) for the same type of offences.

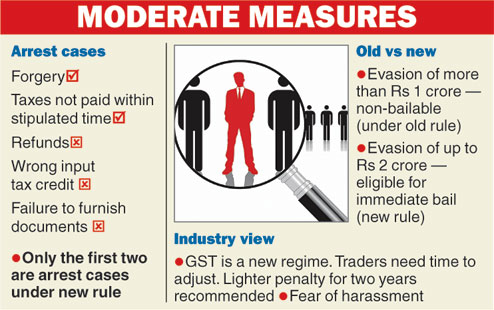

Under the model GST law, offences recognised as "cognizable and non-bailable" for "arrest" are those where the amount of tax evaded (including wrong input tax credit and refund taken wrongly) exceed Rs 1 crore.

India Inc had expressed its concern over the penal provisions in the proposed new indirect tax regime.

Naushad Forbes, president of the CII, said at the Vibrant Gujarat summit: "There is a provision to arrest an industrialist for non-bailable offences, which covers five different potential offences. The tax laws provide for only one offence, that is, if you collect taxes and do not pass it on to the government."

"We believe the best way to control a firm is to have an independent firm to scrutinise the process and be accountable only to the GST Council. But even if one needs these provisions, can they be made quite simple and transparent so that there isn't any scope for discretion and harassment?" he wondered.

The GST Council in its last meeting had decided that the provision of arrest will be restricted to forgery and non-deposit of collected taxes with the exchequer within the stipulated timeframe.

Under the existing service tax rules, arrest provisions kick in for evasion of more than Rs 2 crore, while in excise, the trigger is Rs 50 lakh.

PwC leader (indirect tax) Pratik Jain said the arrest provisions under the revised model GST law may lead to undue harassment of traders.

"To start with, there should be lighter penal provision for offences for at least two years as GST is a new tax regime and traders would need time to understand the law," Jain said.

Finance minister Arun Jaitley in last year's budget had proposed to raise the monetary limit to arrest service tax evaders to Rs 2 crore from Rs 1 crore and this would apply to cases wherein the service tax has been collected from customers but not deposited with the exchequer.

Under IPC 1860, forgery and cheating are non-bailable offences, which mean that bail can only be granted by a court.

Though anti-profiteering and prosecution provisions may act as a deterrent to tax evasion, these are likely to do more harm than good under GST, KPMG (India) partner indirect tax Harpreet Singh said.

"Whenever sweeping powers are given to officials with discretion and subjectivity, it is likely to result in rampant misuse of authority creating hardships for GST dealers," Singh said.

Most other offences such as availing oneself of wrong input tax credit or refund and failure to furnish documents, which were earlier listed in the revised draft GST law for prosecution, will not lead to arrest but may attract only financial penalty.

Meanwhile, a tussle has broken out between the CAG and the GST Council over the right of the government auditor to check government books vis-à-vis the new tax regime.

While the CAG had demanded the right to call for any information for audit of GST receipts and utilisation of their funds, the council had agreed to specifically keep out this provision from the draft rules.