Mumbai, March 11: The government today moved to fill up the vacuum in top positions at some state-run banks when it cleared the appointment of nine executive directors.

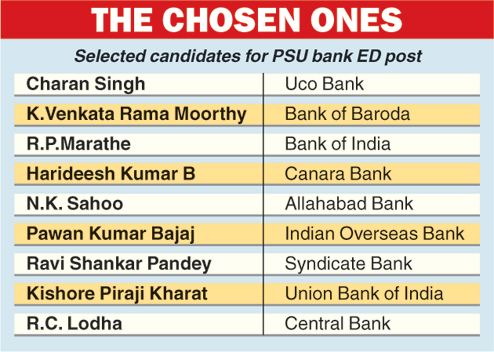

The vacancies had occurred at Uco Bank, Bank of Baroda, Bank of India, Canara Bank, Allahabad Bank, Indian Overseas Bank, Syndicate Bank, Union Bank of India and Central Bank of India.

The appointees today were interviewed in December by a government-appointed selection panel headed by Reserve Bank of India governor Raghuram Rajan. The panel had interviewed 35 candidates to fill the vacancies of 14 executive directors (ED) in various public sector banks.

Earlier this year, the government changed the appointment process for top posts in nationalised banks by allowing private sector candidates to also apply.

However, the rule change did not affect the selection of executive directors as the candidates had been already shortlisted.

In January, the government also broke from convention by splitting the post of chairman and managing director of public sector banks while naming the chief executive officer-cum-MD of four entities - United Bank, Oriental Bank of Commerce, Vijaya Bank and Indian Overseas Bank.

It has now invited applications for the same posts in five more PSU lenders.

The bankers who have been elevated to the post of executive director today include Charan Singh, general manager of the Bank of India, for Uco Bank and N.K. Sahoo for Allahabad Bank.

K. Venkata Rama Moorthy, general manager of the Bank of Baroda (BoB), has been elevated to the post of ED of the same bank, while R.P. Marathe, general manager of the BoB, will assume charge as executive director of Bank of India.

The government decided to change the appointment process of top posts in nationalised banks following the arrest of the former chairman & managing director of Syndicate Bank, S.K. Jain.

Recap fund

The government today said it has limited fiscal space to recapitalise PSU banks and they can raise funds from the market to meet their capital needs.

"The government doesn't have space to give Rs 20,000 crore or 25,000 crore (for capital infusion) ... If banks require further capital they have other means to raise capital, including from the market," financial services secretary Hasmukh Adhia said.

In the budget, finance minister Arun Jaitley had proposed infusing Rs 7,940 crore next fiscal in public sector banks to help them to maintain adequate capital.