In a relief to founders of start-ups, the capital market regulator will allow them to hold on to their Employee Stock Options (ESOPs) post listing.

Under the existing regulations, promoters are ineligible to hold or be granted share-based benefits, including ESOPs. If they held such share-based benefits at

the time of filing the draft red herring prospectus (DRHP), they were required to

liquidate such benefits before the IPO.

The decision is expected to convince start-up founders to come to the public markets amid concerns following a recent instance where One97 Communications’ MD and CEO, Vijay Shekhar Sharma, had to voluntarily surrender 2.1 crore shares worth about ₹1,800 crore, which were granted at the time of listing.

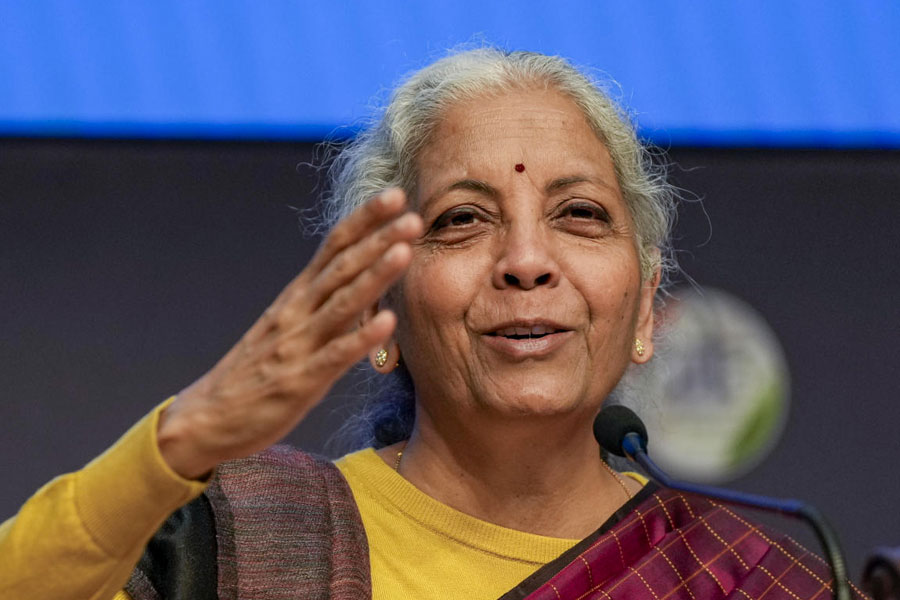

“The proposal approved by the board shall facilitate founders who received such benefits at least one year before the filing of a DRHP with the board, to continue holding, and/ or exercising such benefits even after being specified as the promoter/s and the company becoming a listed entity,” Sebi chairman Tuhin Kanta Pandey said on Wednesday. Pandey, however, clarified that an industry proposal to allow fresh ESOP benefits for founders after listing was not approved by the board.

Demat mandatory

The Sebi board has approved the proposal to mandate dematerialisation of shares by a wider group of stakeholders during the filing of a DRHP. At present, only promoters are required to hold their shares in demat form at the time of filing the IPO. Under the new framework, the list includes selling shareholders, key managerial personnel (KMP), senior management, qualified institutional buyers (QIBs), directors, employees, shareholders with special rights and entities regulated by financial sector regulators as well.

Delisting of PSUs

The Sebi board has approved measures to allow easier voluntary delisting of public sector undertakings, other than banks, NBFCs and insurance companies, when the shareholding of the government as a promoter and/or other PSUs equals or exceeds 90 per cent.

“The requirement of the threshold of approval by public shareholders in favour of the delisting set at a third majority is dispensed with. Delisting of such an eligible PSU would be only through a fixed price delisting process, which shall be at least 15 per cent premium over the floor price,” said Pandey.

Merchant banker relief

Sebi has conditionally allowed merchant bankers to undertake activities falling outside the regulator’s purview. This is significant because in its December 2024 board meeting, Sebi had approved that the non-regulated activities by merchant bankers be hived off to a separate legal entity.

Merchant bankers have been allowed to undertake activities which are not within the purview of Sebi or any other financial sector regulator, provided they are fee-based, non-fund-based activities and pertain to the financial services sector.

Other changes

Sebi has also approved a set of relaxations for foreign portfolio investors (FPIs) that invest exclusively in government securities (G-Secs), designated as GS-FPIs.

This comes in the light of India’s entry into global bond indices and is aimed at easing operational compliance and boosting foreign investment into Indian sovereign debt.

Among the ease of doing business measures for angel funds include relaxation of floor and cap for investment in an investee company from ₹25 lakh–₹10 crore to ₹10 lakh-₹25 crore, respectively, removal of concentration limit of 25 per cent of total investments of angel funds in an investee company, allowing contributions from more than 200 accredited investors, enabling a follow-on investment in an investee company which is no longer a start-up among others.

In order to increase operational flexibility and reduce the compliance burden on AIF players, Sebi has permitted co-investment opportunities in the unlisted securities under the AIF framework.

It has also cleared the proposal to do away with the prohibition on AIF investment managers from providing advisory services in listed securities.

In case of Real Estate Investment Trusts (REITs) and Infrastructure Investment

Trusts (InvIT), the regulator has introduced greater flexibility in the distribution of cash flows.