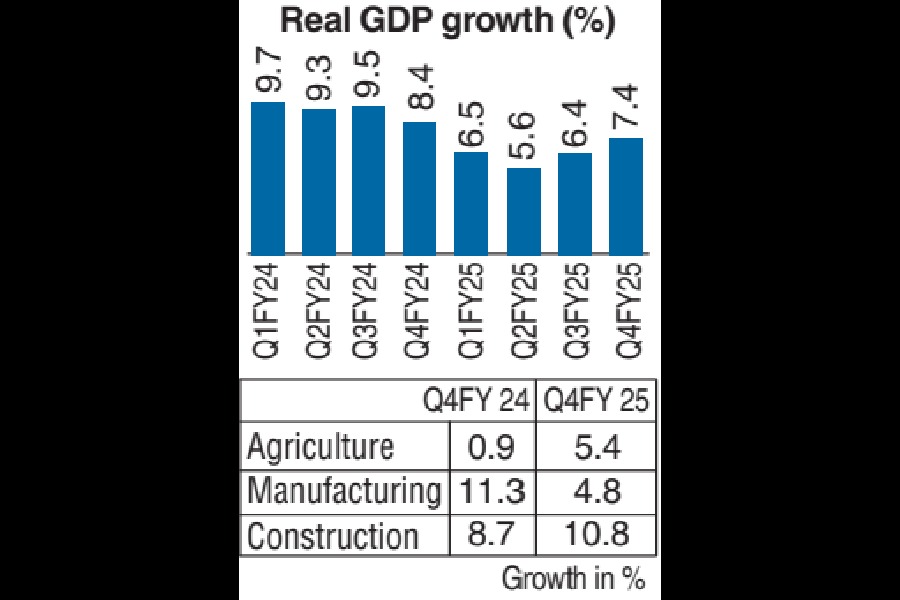

The Indian economy grew 7.4 per cent in Q4FY25, higher than 6.4 per cent in Q3FY25 but lower than 8.4 per cent in Q4FY24.

The Q4FY25 growth numbers were marginally ahead of analyst estimates, who pointed to a sharp growth of 5.4 per cent in agriculture compared with 0.9 per cent in Q4FY24. However, manufacturing disappointed with a growth of 4.8 per cent in Q4FY25 compared with 11.3 per cent in Q4FY24.

“Manufacturing has seen feeble growth because of slow urban demand and also global uncertainties (reflected in slower export growth). However, if we look sequentially, there has been an improvement in manufacturing growth from 3.6 per cent in Q3FY25 to 4.8 per cent in Q4FY25,” Rajani Sinha, chief economist, CareEdge Ratings, told The Telegraph.

“Last year, the monsoon was good, and rural demand has been strong. So we are seeing a good growth in the farm sector as expected,” Sinha said.

“The high growth in manufacturing in Q4FY24 came on the back of a very low base, partly attributable to the impact of the commodity prices cycle on margins. While the year-on-year GVA growth in manufacturing in Q4FY25 is undoubtedly lower when compared with the year-ago quarter, it is higher in sequential terms, which is a positive sign,” Aditi Nayar, chief economist, Icra, told this newspaper.

In absolute numbers, real GDP in Q4FY25 is estimated at ₹51.35 lakh crore against ₹47.82 lakh crore in Q4FY24. Nominal GDP in Q4FY25 is estimated at ₹88.18 lakh crore against ₹79.61 lakh crore in Q4 of 2023-24 — a rise of 10.8 per cent.

Real Gross Value Added (GVA) in Q4FY25 is estimated at ₹45.76 lakh crore against ₹42.86 lakh crore in Q4FY24, registering a growth rate of 6.8 per cent. Nominal GVA in Q4FY25 is estimated at ₹79.46 lakh crore, against ₹72.51 lakh crore in Q4FY24, showing a growth rate of 9.6 per cent.

The construction segment grew 10.8 per cent in Q4FY25 from 8.7 per cent in Q4FY24. The electricity, gas, water supply, and other utility services segments grew 5.4 per cent during the fourth quarter, down from 8.8 per cent in the year-ago period.

GVA growth in the services sector — trade, hotel, transport, communication and services related to broadcasting — is estimated at 6 per cent in the fourth quarter, lower than 6.2 per cent a year ago.

Financial, real estate and professional services grew 7.8 per cent in the March 2025 quarter compared with 9 per cent in the year-ago period. Public administration, defence and other services posted almost flat growth at 8.7 per cent in the quarter.

Private final consumption expenditure grew 6 per cent in Q4FY25, down from 6.2 per cent in Q4FY24. Exports growth at 3.9 per cent in Q4FY25 was down from 7.7 per cent in Q4FY24.

GVA-GDP gap

A high net tax growth of 12.7 per cent in Q4FY25 resulted in a wide gap between the GVA and GDP numbers.

“The divergence between GDP and GVA is concerning because it points to rapidly rising demand while the production side growth lagged. The possibility of a wide gap between GVA and GDP could also be because of strong tax collections and lower subsidies, which may explain the contraction in government spending,” said Rumki Majumdar, economist, Deloitte India.

Economists remain optimistic that the government will meet its budgeted growth of tax aggregates and deficit targets and predict further rate cuts by the RBI in the next monetary policy meet in June.

“We expect the benign inflation and soft growth to continue to provide the MPC room for incremental monetary easing, with a 25 basis point cut in the upcoming June policy,” said Upasna Bhardwaj, chief economist, Kotak Mahindra Bank.