The Indian stock markets have started to display all the characteristics of a gigantic betting shop where greed and reckless speculation can burn paper wealth on the roll of a dice.

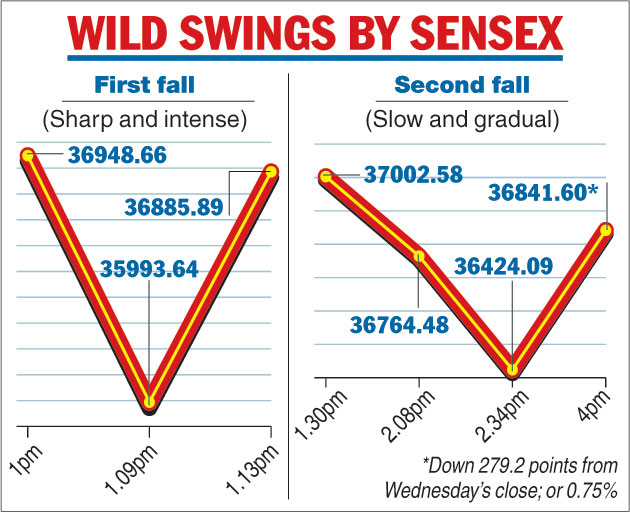

On Friday, the truth of this assertion played out over an intense eight-minute, gut-wrenching down whoosh that saw the bellwether Sensex plunge almost 1,000 points to the day’s low of 35,993.64 points before it bounced back — as inexplicably — to 36,885.89 in the space of the next five minutes.

Market veteran Madhusudhan Kela summed up the 13-minute roller-coaster ride that clobbered stocks, especially non-banking finance company and housing finance shares, most eloquently: “Yeh satta bazaar hai; yahan kuchh bhi ho sakta hai (This is a betting shop, anything can happen here).”

Kela, chief investment strategist with Reliance Capital and a battle-scarred veteran of many market mayhems, told a news channel: “Main saalon se bolte aa raha hoon ki ya to news achchha hoga, ya bhav achchha hoga. Jab news kharab hai to bhav achchhe hote hain or jab news achchha hota hai to bhav kharab hote hain (I have always said that either the news is good or the price is good. If news is bad, the price will be good. If the news is good, the market prices will be bad).

The brittleness of the Indian stock market stood out in sharp contrast to the world markets: China’s blue-chip CSI300 index rose 3.0 per cent, recording its biggest one-day gain since May 2016.

Euro Stoxx50, Eurozone’s blue chips index, was up 0.9 per cent and heading into a 10th straight session of gains, a performance not seen since 1997. In Britain, the FTSE 100 was up 0.9 per cent by 0820 GMT, climbing in line with European benchmarks as investors piled into stocks in relief that US-China tariffs were less high than feared.

Indian investors broke ranks with the rest of the world, choosing not to focus on the global cues. They were gripped by fears of a sharp rise in borrowing costs that an anticipated two-step interest rate hike of as much as 50 basis points would trigger and a general sense of unease with the volatility in the money markets because of an incipient liquidity crisis.

“Today’s volatility is clearly the handiwork of a bear cartel playing on rumour-mongering. Surveillance can easily spot it,” tweeted Sandip Sabharwal, an investment adviser, while referring to the provisional data on trading done by foreign portfolio investors (FPIs) and domestic institutional investors (DIIs).

The NSE data showed that while FPIs made net purchases of almost Rs 761 crore, the DIIs bought shares worth Rs 497 crore.

Keki Mistry, vice-chairman and CEO, HDFC, told a business news channel that there was nervousness on the Street because of the lack of liquidity in the money markets.

The fears were also fanned by market buzz that debt paper floated by a housing finance company had been sold at a relatively higher yield, which sparked the mad scramble to dump stocks.

Jagannadham Thunuguntla, senior vice-president and head of research (wealth) at Centrum Broking, however, felt that Friday’s crash was the combined result of the perilous slide in the value of the rupee and the hardening of bond yields.

“It was a gut-wrenching day in the markets, with free fall across the market with almost no place to hide. The macro meltdown in terms of relentless rupee weak weakness and bond yield hardening has finally had its impact on the market,” he added.

Kela had a word of caution for investors. “If you are on the right side of speculation and if you are a long-term investor, and do not understand company fundamentals, then do not buy (the stocks of) individual companies. Instead, invest your money in mutual funds. But if you do understand companies and fundamentals, then this is a great opportunity to buy.”

The Great Indian Casino will open on Monday after investors and speculators have had time to chew on facts and rumours – and speculate about the timing of the Modi government’s next big announcements to prop up the faltering rupee that will include the promised import restrictions on “non-essential” goods.