The BSE Sensex plunged more than 1400 points on Friday over fears of a full blown global trade war and worries over a slowing US economy as investors lost more than ₹9 lakh crore in the day.

The fresh jitters came after US President Donald Trump said that he would impose 10 per cent additional tariff on Chinese imports apart from proceeding with 25 per cent levies against Mexico and Canada next week.

His announcement led to concerns of retaliatory actions by affected nations, which would lead to higher inflation and stymie global growth.

If Trump’s policy announcements were not enough, economic data from the US were also not encouraging.

Jobless claims for the week ended February 22 stood at a seasonally adjusted 242,000 — a rise of 22000 over the previous week’s level. It was also higher than Dow Jones estimate of 225,000. The number led to apprehensions that the US economy was showing signs of tiring.

For equity investors in India, Trump’s statement came at a time prices have already taken a hit because of persistent foreign portfolio investor (FPI) outflows and valuation worries given the tepid corporate results.

Provisional data from the NSE showed FPIs selling stocks worth a whopping Rs 11,639 crore on Friday. However, they were offset by domestic institutions who purchased stocks to the tune of Rs 12,309 crore.

So far in this calendar year, the FPIs have sold stocks worth $13 billion.

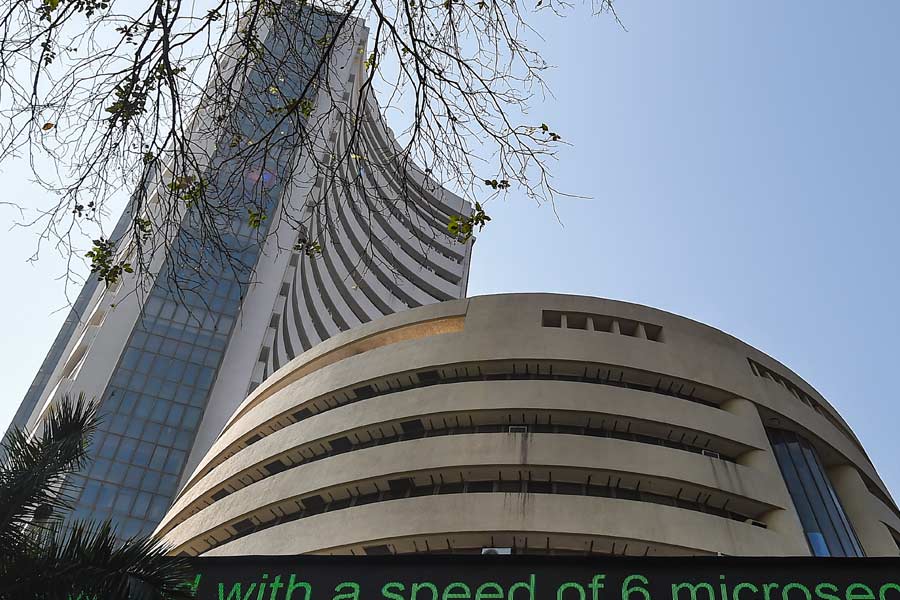

Reflecting the havoc, the 30-share Sensex opened lower at 74201.77 and plunged 1471.16 points or 1.97 per cent to a day’s low of 73141.27. It later settled at 73198.10 — a fall of 1414.33 points or 1.90 per cent.

On the NSE, the Nifty slumped 420.35 points or 1.86 per cent to 22124.70.

From its record peak of 85978.25 hit on September 27 last year, the BSE gauge is down 12780.15 points or 14.86 per cent.

Similarly, the Nifty has plummeted 4152.65 points or 15.80 per cent from its lifetime high of 26277.35 hit on September 27, 2024.

According to Puneet Singhania, director at Master Trust Group, the benchmarks indices have been pulled down by worries about Trump's trade proposals, slowing economic growth, waning earnings momentum and persistent selling by foreign investors.

"The national market experienced a sharp decline amid heightened bearish sentiment largely influenced by weak global cues. The decline was largely triggered by fear of the implementation of 25 per cent tariff on US imports from Canada and Mexico, set to take effect next week, along with an additional 10 per cent tariff on Chinese goods," Vinod Nair, head of research, Geojit Financial Services, said.

Rupee crash

The nervousness also spread to the forex markets, with the rupee crashing almost 30 paise to settle at 87.50 against the dollar. At the interbank market, the currency opened weaker at 87.34 as the dollar Index (DXY — which measures the unit’s movement against a basket of six other global currencies) opened firm at 107.25, after hitting an intra-day low of 87.53. The rupee closed at 87.50.