New Delhi, Sept. 15: Reports that the commerce ministry was considering a calibrated devaluation of the rupee to make exports more competitive sent the Indian currency reeling today, prompting the North Block to deny any such move and put in motion a salvage operation by state-run banks.

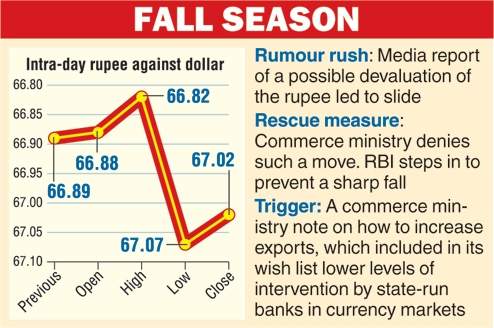

The rupee opened at 66.88, touched an intra-day high of 66.82 before plunging to a low of 67.07. However, intervention by the state-run banks, which sold dollars in tandem with the Reserve Bank of India, helped it to recover and close at 67.02 against Wednesday's close of 66.89.

"The value of the rupee is determined by the market and there is no plan to change policy," economic affairs secretary Shaktikanta Das told reporters. "Reports that the government wants to devalue the rupee are false."

Commerce minister Nirmala Sitharaman, too, denied that she had said the government was discussing a devaluation.

A policy-maker stressed that the Reserve Bank of India did not set the rupee's exchange rate and is "there only to contain volatility.

"The RBI will always allow the market to decide the rupee's right price," the policy-maker said. "The RBI doesn't believe in devaluing the currency. It also doesn't make sense because our imports are more than our exports."

The rumours seemed to have got credence from the fact that monetary policy will now be decided by a panel with equal representation from the government and RBI - and will not be the sole prerogative of the central bank.

Reports suggested that the commerce ministry had prepared a cabinet note seeking a calibrated devaluation in the value of the rupee to help Indian exports, which had fallen in April-July 2016 to $87 billion from $90 billion in the same period last year. Exports in July fell 6.8 per cent from a year earlier, but imports fell faster by 19 per cent, on low oil prices, creating a trade deficit of $7.8- billion.

The rupee devaluation rumours were triggered, according to some North Block officials, by the commerce ministry suggesting limited intervention by banks in the currency markets.

"They (commerce ministry) have in the past advocated a freer fall of the rupee. That cannot be done. The rate is market determined and the RBI merely intervenes to check volatility. If the rupee starts appreciating at a fast pace, the RBI will intervene to slow its growth. If it depreciates at a fast rate, the RBI will again intervene, to slow its fall," officials said.

Eyes on Fed

A planned increase in the US Fed bond rate is expected to drain out dollars from many emerging market economies.

However, given the country's strong foreign currency reserves of $367 billion (August-end), India is expected to be able to ride out the storm, with much lower depreciation of the rupee than similarly placed countries, including Russia, Brazil and South Africa.#

The threat of a rise in US Fed rates had an adverse effect on the rupee in 2013, pushing the currency to a record low of 69 to the dollar. A fall in the rupee value spikes inflation rates as India's import bill becomes costlier in rupee terms.