|

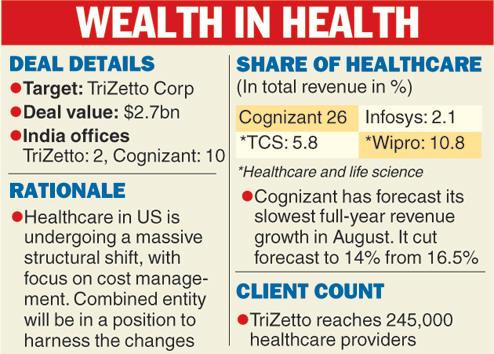

Calcutta, Sept. 15: Cognizant struck its biggest deal on Monday, acquiring healthcare IT services provider TriZetto Corp for $2.7 billion to beef up its slowing healthcare business.

Shares of the company, which is buying TriZetto from London-based private equity firm Apax Partners LLP, rose nearly 3 per cent in pre-market trading. The company has a global development hub in the city.

Cognizant’s healthcare business, which accounted for about 26 per cent of total revenue in 2013, has declined in the last three quarters.

The firm had reported a net profit at $371.9 million in the April-June quarter this year on a revenue of $2.16 billion.

The company provides services such as claims processing, billing and call centre operations to insurers, hospitals and some US government-run healthcare exchanges set up under President Barack Obama’s Affordable Care Act, also known as Obamacare.

TriZetto provides information technology services, including care management and the administration of benefits. The company said it reaches 245,000 healthcare providers, representing more than half of the insured population in the United States.

Englewood, Colorado-based TriZetto is the latest US healthcare IT services provider to be acquired as payers and providers of healthcare seek new ways to cut costs. Founded in 1997, TriZetto has 13 offices in the US and two in India.

The acquisition will create an entity with more than $3 billion in combined healthcare revenue. The transaction is expected to close in the fourth quarter of 2014.

“Healthcare is undergoing structural shifts due to reform, cost pressure and shifting responsibilities between payers and providers,” Cognizant CEO Francisco D'Souza said in a statement.

“This creates a significant growth opportunity, which TriZetto will help us to capture.”

Cognizant will finance the deal through a mix of cash and debt. It has secured $1 billion of committed financing for the transaction.

Through the deal, the New Jersey-based Cognizant aims to tap the rapidly changing healthcare marketplace, which is about 17 per cent of the US gross domestic product of over $17 trillion.

Cognizant president Gordon Coburn said: “It (acquisition) represents a great opportunity to integrate services across our three horizons — traditional IT services, high-growth businesses such as management consulting, business process services and IT infrastructure services and emerging delivery models.”

TriZetto’s 3,700 employees will blend into Cognizant’s healthcare business, which serves more than 200 clients, including 16 of the top 20 US health plans and four of the top five pharmacy benefit management companies. For the transaction, Cognizant was advised by Credit Suisse, UBS Securities LLC and Centerview Partners.

According to Jude Dieterman, president and COO, TriZetto, a combination of Cognizant and TriZetto’s employees, technology and operations is expected to have a meaningful impact on the manner health is managed.

“TriZetto solutions enable the healthcare interactions of millions of people in the US every day. Our agreement with Cognizant advances our vision of simplifying healthcare for everyone,” he said.