Calcutta: The Centre expects the rupee, which has breached the 70-mark against the dollar, to soon stabilise at around 68-69 levels as the fundamental demand-supply position of the currency remains unaltered on account of stable oil prices and positive interest among foreign investors.

"This breaching of the 70 (mark) was on account of external factors largely for what happened in Turkey. Our fundamental equation for the trade account has not changed. Oil prices have not gone up.

"Therefore, the demand-supply situation for dollars in the Indian economy has not got altered... our perception is that very soon it will stabilise and it might go back to 68-69 levels," Subhas Chandra Garg, secretary in the finance ministry's department of economic affairs, said on Saturday.

He was speaking on the sidelines of an event organised by the Merchant Chamber of Commerce.

Emerging market currencies, including the rupee, have been under pressure recently because of the developments in Turkey, triggered by threat of sanctions from the US, which has led to investors betting on safe havens such as the dollar.

The rupee has been among the worst performing currencies of Asia this year as it has depreciated over 9 per cent against the dollar. In August, it has taken a hit of more than 2 per cent.

However, Garg said though the currency has taken a hit, investor perception about India has not. Data on foreign portfolio investments from National Securities Depository Limited shows there was a net outflow of Rs 51,326 crore between April 1, 2018 and August 18, 2018.

But Garg said most of the outflow was during the first three months of the year and the trend has reversed in August.

"There was an outflow of $9 billion in terms of portfolio investments in the first three months of the current fiscal and last year, we had an inflow of $20 billion. But in July, there was no outflow. In August, there is positive inflow," Garg said.

"This makes it clear that the episode arising out of Turkey essentially does not alter FPIs' (foreign portfolio investors) perception about India. I do not think that will change," he added.

Analysts, however, remain sceptical about a recovery in the currency in the short term amid global concerns.

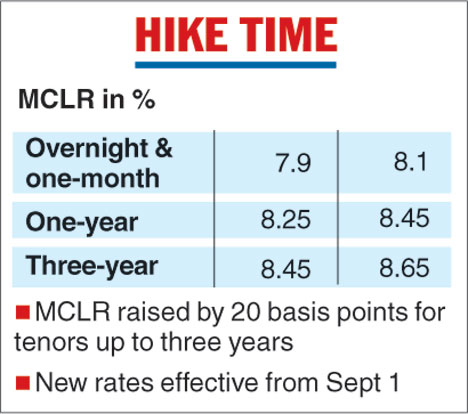

"Except the Japanese Yen, most Asian currencies are under pressure and the rupee has been the weakest amongst the Asian pack. Capital flows have been a bigger concern though the RBI is trying to rescue the scenario by increasing the rates, but the intervention has been slow as it very well knows that depleting reserves against the global wave of dollar strength is not going to yield much benefit," said Kishore Narne, head of commodity and currency, Motilal Oswal Securities.

"Year-to-date fall for the rupee has been to the tune of 9 per cent and we expect it to worsen further in the short term. But we still have a war chest of nearly $400 billion of forex reserves and inflation under 5 per cent which means if growth returns it takes no time for the fundamentals to revive and the rupee to gain its lost ground," said Narne.

Bank recovery

Garg said public sector banks, which are under Prompt Corrective Actions (PCA) imposed by the RBI, would do better going forward and there would be lesser requirement for provisioning of bad loans. "Profitability of these banks will be coming back. They are expected to come out of PCA in the next 1-2 years," he said.