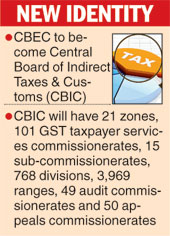

New Delhi, March 25: The government is reorganising the Central Board of Excise and Customs and will be renaming it the Central Board of Indirect Taxes & Customs (CBIC), as part of the run up to usher in the goods & services tax.

The finance ministry said in a tweet that "finance minister Arun Jaitley has approved the reorganisation of the field formations of the CBEC for the implementation of GST".

The reorganised body will help the government with inputs for its GST policy, besides being the new All-India indirect tax administration structure, officials said.

The All-India CBIC, which in essence would be an expanded version of CBEC, will have some 21 zones, 101 GST taxpayer services commissionerates, 15 sub-commissionerates, 768 divisions, 3,969 ranges, 49 audit commissionerates and 50 appeals commissionerates.

The existing formations of central excise and service tax under the CBEC have been re-organised to implement and enforce the provisions of the proposed GST Laws, officials said.

The renamed Directorate General of Goods & Service Tax Intelligence is also being expanded to help curb black money generation by traders and factories.

"This will ensure taxpayer services to all through an indirect tax administration structure, having a pan-India presence," a finance ministry statement said.

The existing indirect tax training establishment will be renamed National Academy of Customs, Indirect Taxes and Narcotics and will have an all-India presence, to help train not only central government taxmen but also state officials.

"The reorganisation was due as the government had to redefine its offices and reorient its officers to administer a new kind of tax ahead of the launch of the GST by July or September," said Subrata Sen, a tax consultant.