Federal Bank on Friday said its board has approved a proposal to raise ₹6,196 crore through the issuance of preferential warrants to a Blackstone group entity, Asia II Topco XIII Pte Ltd, adding to the growing list of large deals in the banking, financial services and insurance industry (BFSI) in 2025.

In a regulatory filing, the bank said it will issue over 27.29 crore preferential warrants at a price of ₹227 per warrant to the Blackstone entity, aggregating to ₹6,196 crore. The warrants, convertible into equity shares within 18 months from the date of allotment, will be issued on a private placement basis.

Upon full conversion of the warrants, Asia II Topco XIII Pte Ltd will hold 9.99 per cent of Federal Bank’s paid-up share capital. The deal will make the private equity firm the largest shareholder in the bank.

The bank has executed an investment agreement dated October 24, 2025, with the investor.

As part of the deal, the board has approved granting a special right to the investor to nominate one non-executive director to the bank’s board, subject to the conversion of all warrants and a minimum shareholding of 5 per cent.

To seek shareholder approval for the preferential issue and the associated special rights, Federal Bank will convene an extraordinary general meeting on November 19, 2025.

Following the announcement, shares of Federal Bank gained in early trade, touching the day’s high of ₹232.25 on the BSE, before paring gains to close the day’s trade at ₹227.40 on Friday.

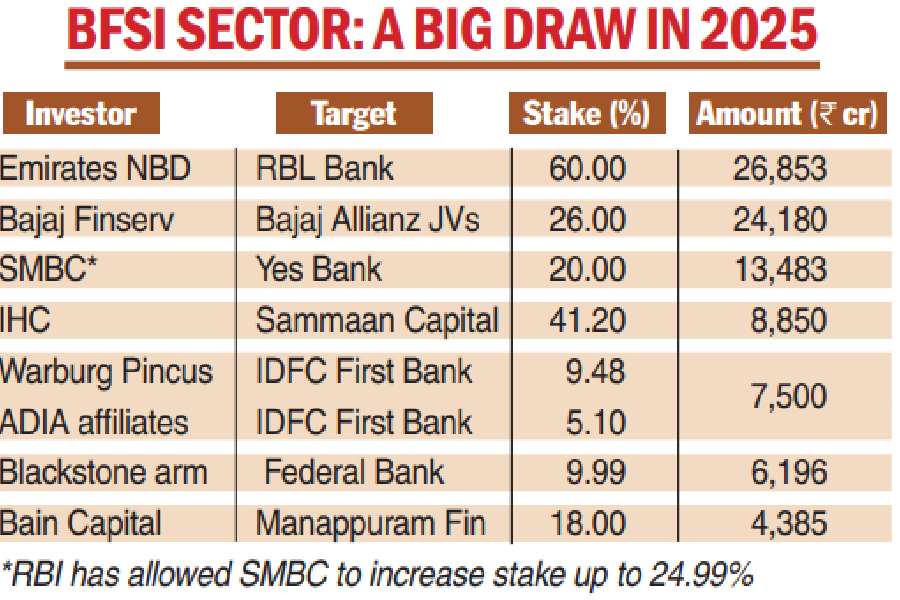

The investment underscores continued global investor interest in India’s banking and non-banking financial services sector, which has seen heightened deal activity (see chart) amid improving credit growth and asset quality trends.

“Long-term dealmaking in the banking and financial services space demonstrates that there continues to be strong interest in strategic opportunities with a long-term view on growth and value creation,” said Vishal Agarwal, partner and private equity venture capital channel leader, Grant Thornton Bharat.

“(This) renewed interest in the wider financial space hinges on the ability of Indian investors, promoters and regulators to nurture this ecosystem, enabling it to grow in depth and reach while containing risks more effectively than before,” Agarwal said.