New Delhi, Sept. 24: The government today said it would amend income tax laws to exempt foreign companies from MAT retrospectively from 2001. The relief comes at a time Prime Minister Narendra Modi is in the US where he will meet top corporate honchos.

The US is among the largest investors in India, accounting for a little over 30 per cent of foreign investments in the country. Modi's dinner date on Thursday with select Fortune 500 US chiefs - including PepsiCo CEO Indra Nooyi, Ford Motor president Mark Fields and Johnson & Johnson chairman Jorge Mesquita - is meant to drum up more greenbacks.

The announcement, which will help a large number of firms, including US companies, was timed for effect, admitted senior revenue department officials.

"We had taken the decision some time back, but we announced it today," said a top official.

The latest MAT relief could also have a bearing on the Castleton Investment case, which is before the Supreme Court now and scheduled for hearing next week.

In the Castleton ruling, the Authority for Advance Rulings had held that since the MAT provisions under the Income Tax Act 1961 did not make a distinction between Indian and foreign companies, the tax was applicable to foreign companies.

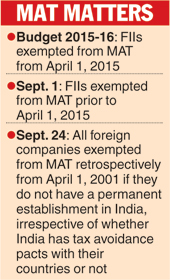

Under the latest decision, foreign companies, irrespective of whether they belong to a country with which India has a Double Taxation Avoidance Agreement, have been exempted from the minimum alternate tax (MAT) on profits from April 2001 if they do not have a place of business in India, a finance ministry statement said.

The provisions of Section 115JB of the income tax act will not apply to foreign companies with effect from April 1, 2001 if they are resident of a country with which India has a Double Taxation Avoidance Agreement (DTAA) and they do not have a permanent establishment in India.

In case the companies belong to countries with which India does not have a DTAA, the MAT exemption will apply if they are exempted from registration under Section 592 of the Companies Act 1956, or Section 380 of the Companies Act 2013.

Under these sections, firms are exempted from registration if they do not have a "place of business" in India.

"An appropriate amendment to the income tax act in this regard will be carried out," the finance ministry said.

Earlier this month, the government had exempted foreign institutional and portfolio investors from the payment of MAT on the capital gains made by them before April 1, 2015. Budget 2015-16 had already exempted FIIs/FPIs from paying the levy on gains made after April 1.

Officials said the cut-off of April 2001 had been decided as India signed most of its critical double taxation avoidance treaties on or after 2001.

Earlier, the US-India Business Council had said: "Increasingly over the past two years tax has become a headline policy issue in the US-India commercial relationship."

Sunil Shah, partner, Deloitte Haskins & Sells, said: "This will give relief from the MAT provisions to all foreign companies which have no presence in India."