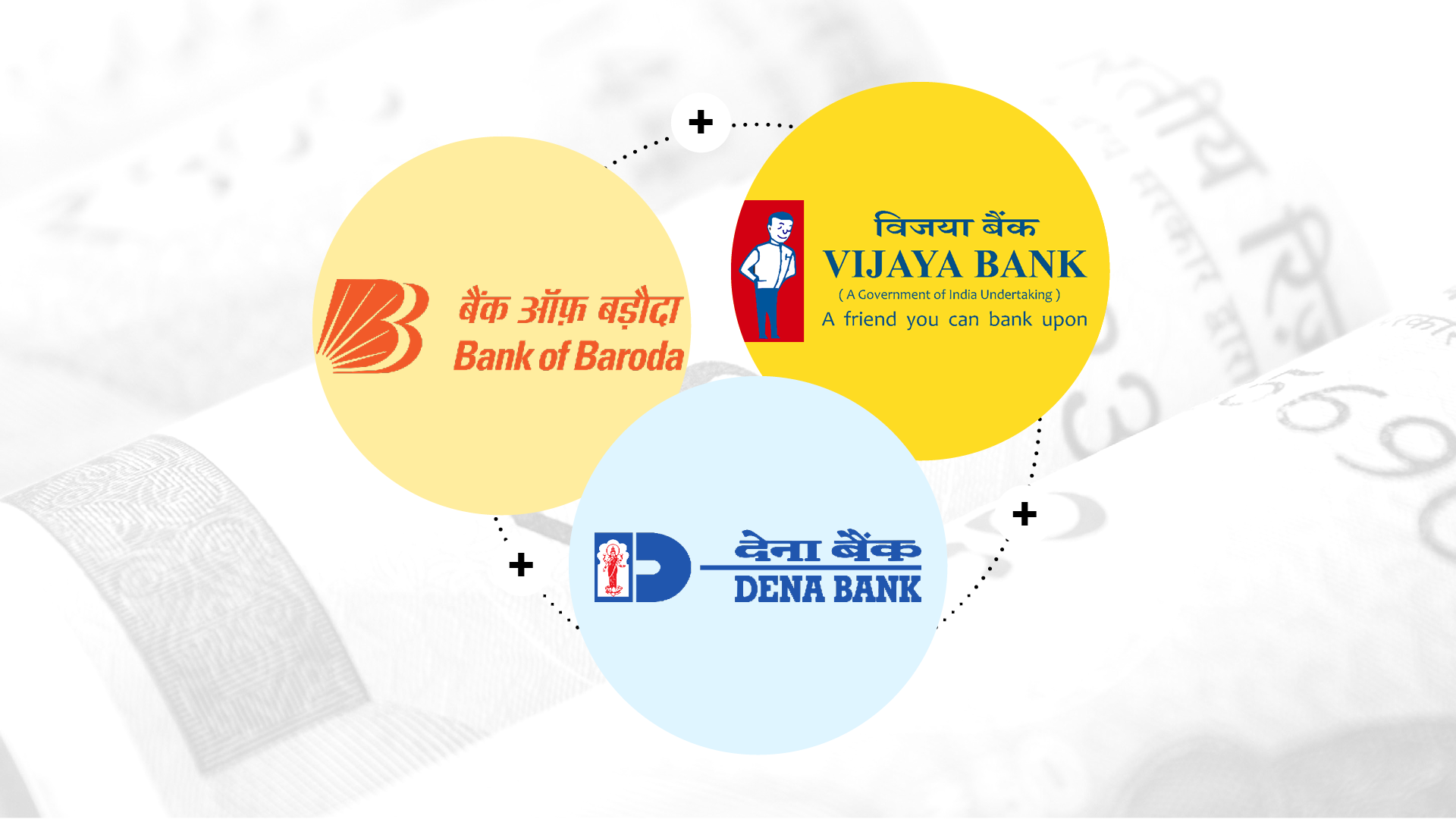

Mumbai/New Delhi: The proposed merger of Dena, Vijaya and Bank of Baroda, which will create the country's third largest lender, will face various challenges even as the move raises the prospects of more weak banks being merged with stronger entities.

Brokerages feel that though the move was positive its impact would be felt on the merged entity only in the long- run. The proposal could face several challenges in the short- term.

"Besides financials, challenges from human resource, process integration, branch rationalisation and management bandwidth will also pose integration risks. Agitation by employees cannot be ruled out,'' analysts at Edelweiss Securities said in a report.

They added that the reappointment of BoB chief executive P.S. Jayakumar as the managing director & CEO was also critical for smooth integration of the merger.

"The proposed merger prolongs the uncertainty for other stronger banks (Indian Bank, State Bank of India), which may have to absorb about a dozen weak banks,'' they said.

"While the move is arguably one more step towards public sector bank reforms, the challenges do persist,'' analysts at HDFC Securities said.

The merger will be credit positive as it would improve the three banks' efficiency and governance, Moody's said on Tuesday.

"We expect the merged entity will require capital support from the government, otherwise such a merger would not improve their capitalisation profile," Moody's Investors Service VP (financial institutions group) Alka Anbarasu said.

Moody's said BoB and Vijaya have relatively better credit metrics than Dena in terms of asset quality, capitalisation and profitability.

"The merger of two strong banks (BoB and Vijaya) with a weak bank (Dena) seems like a bailout package for Dena Bank, keeping aside the strong bank's minority shareholder's interests," PhillipCapital in a note said.

On the bourses on Tuesday, BoB shares reacted negatively to the announcement. The scrip crashed over 16 per cent to end at Rs 113.45.

The Vijaya Bank scrip, too, cracked 6 per cent to close at Rs 56.40.

However, the shares of Dena Bank were locked in at the upper circuit as it closed 20 per cent higher at Rs 19.10.