RBI governor Sanjay Malhotra on Wednesday said that the Indian economy is doing well and contributing significantly more to global growth, despite lingering trade uncertainties.

The RBI governor’s observation comes on a day US President Donald Trump has doubled down on his previous threat of penalising India for importing oil from Russia by slapping an additional tariff of 25 per cent. Last week, Trump had called India a “dead economy”.

“We have a very robust growth rate of 6.5 per cent, and according to the IMF, it is 6.4 per cent (against global growth projected at 3 per cent in 2025). We are contributing about 18 per cent, which is more than the US, where the contribution is expected to be much less. We are doing very well, and we will continue to further improve,” Malhotra said at the post-monetary policy press conference on Wednesday.

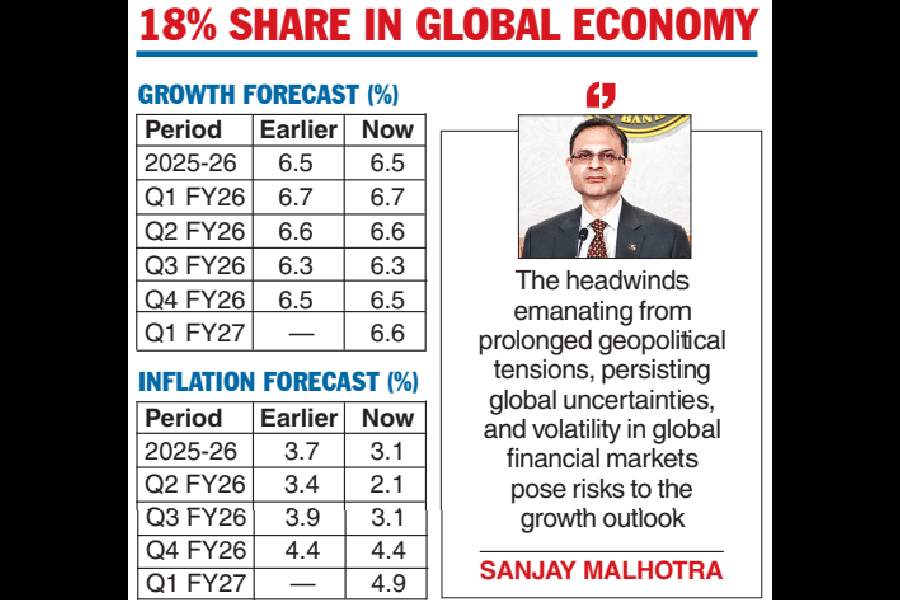

The central bank has kept its growth projections intact for FY26 at 6.5 per cent and estimated the first quarter growth for FY27 at 6.6 per cent (see chart).

“The above normal southwest monsoon, lower inflation, rising capacity utilisation, and congenial financial conditions continue to support domestic economic activity. The supportive monetary, regulatory and fiscal policies, including robust government capital expenditure, should also boost demand. With sustained growth in construction and trade segments, the services sector is expected to remain buoyant in the coming months.

“Prospects of external demand, however, remain uncertain amidst ongoing tariff announcements and trade negotiations. The headwinds emanating from prolonged geopolitical tensions, persisting global uncertainties, and volatility in global financial markets pose risks to the growth outlook,” the RBI governor said.

“In our base case, we project the GDP growth at 6.3 per cent for FY26 (lower than RBI’s projection of 6.5 per cent). However, in the case where tariffs remain elevated at current levels and/or are further raised we see a downside risk of 20-25 basis points to our GDP growth forecast for the year,” said Sakshi Gupta, principal economist, HDFC Bank, adding that the downside risks include impact of higher tariffs on exporters (particularly MSMEs), delay in capex plans and hiring.

Inflation to inch up

The RBI on Wednesday lowered its inflation projections for 2025-26 to 3.1 per cent as headline CPI softened to a 77-month low of 2.1 per cent in June. The central bank also expects inflation to be on an upward trajectory in the remainder of the year and touch nearly 5 per cent in the first quarter of FY27 (see chart).

“The inflation outlook for 2025-26 has become more benign than expected in June. Large favourable base effects combined with steady progress of the southwest monsoon, healthy kharif sowing, adequate reservoir levels and comfortable buffer stocks of foodgrains have contributed to this moderation.

CPI inflation, however, is likely to edge up above 4 per cent in Q4 2025-26 and beyond, as unfavourable base effects and demand side factors from policy actions come into play. Barring any major negative shock to input prices, core inflation is likely to remain moderately above 4 per cent during the year. Weather-related shocks pose risks to inflation outlook,” said Malhotra.

Limited impact

The RBI, however, sees the impact of external developments, including any impact from reciprocal tariffs, having a limited role in influencing India’s inflation.

“Nearly half of the CPI basket consists of food, which does not get impacted by global developments. A significant part also consists of non-tradeables, which do not get impacted by global developments. The first order direct impact of these evolving uncertainties on India’s inflation, therefore, is likely to be limited,” said RBI deputy governor Poonam Gupta.

“While the CPI-based inflation has eased more than expected, an upturn looms in the second half of the fiscal year for three reasons — the upcoming festival season, easier monetary policy propping up demand and an expected statistical uptick from the low base of last fiscal. The MPC remains cautious about the inflation trajectory,” said Dipti Deshpande, principal economist, Crisil.