Mumbai, April 26: Axis Bank has prepared a list of company accounts that can turn into non-performing assets (NPAs).

The country's third-largest private lender today said the size of this pool at the end of the fourth quarter ended March stood at Rs 22,600 crore and that 60 per cent of the list could become NPAs in the next eight quarters.

The bank is the first entity to put such a list in the public domain. Though it did not disclose the identity of the accounts, the bank said they belonged to stressed sectors, groups with high leverage, inconsistent record of payments, rating downgrades or those facing project distress.

In terms of sectoral composition, the iron and steel sector constitutes a bulk of the list (24 per cent), followed by power, textiles, services and oil & gas.

In a presentation on its website, Axis Bank said though it was difficult to predict the timing of the slippage, the accounts were likely to turn bad in the first half of this year.

The watchlist accounts for 13 per cent of the bank's corporate assets and 4 per cent of its total assets during the fourth quarter.

At a conference call after the announcement of the results, the senior management of the bank said the stress outlook remained elevated as the operating environment continued to be challenging.

However, the bank's asset quality during the fourth quarter remained stable. While the gross NPA ratio stood at 1.67 per cent against 1.68 per cent in the preceding quarter, gross NPA in absolute terms rose marginally to Rs 6,087.51 crore from Rs 5,724.05 crore in the third quarter.

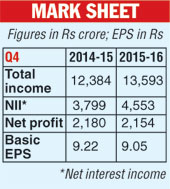

During the quarter, net profits shrunk one per cent to Rs 2,154 crore against Rs 2,180 a year ago. Core net interest income rose 20 per cent to Rs 4,553 crore from Rs 3,799 crore in the previous year.

Advances grew 21 per cent to Rs 3,38,774 crore. Retail loans, which accounted for 41 per cent of net advances, grew 24 per cent to Rs 1,38,521 crore.