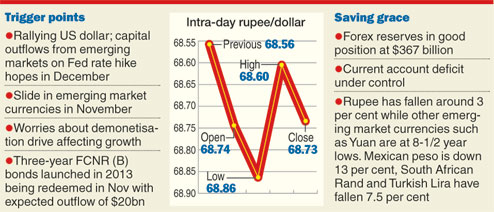

Mumbai, Nov. 24: The rupee fell to a record low of 68.86 on Thursday, pressured by a rallying US dollar, capital outflows from emerging markets and worries about the country's demonetisation drive.

Despite repeated interventions by the central bank, the rupee breached its previous low of 68.85 to the dollar in August 2013, when the country was mired in its worst currency crisis in more than two decades.

The Reserve Bank of India intervened again in the afternoon, after spending around $500 million in the morning, eventually pushing the rupee up to a high of 68.60.

However, the pressure remained, and the rupee closed at 68.73, down 17 paise from its Wednesday close of 68.56.

The finance ministry today said it was closely monitoring the currency movement. It also indicated that there may not be any direct intervention till the rupee falls below a certain level.

A government spokesman attributed the fall to the recent slide in emerging market currencies, which has also seen the Chinese yuan hit 8-1/2 year lows.

The Indian currency has fallen around 3 per cent this month, the biggest against the dollar since August 2015, though it has fared better than many other emerging market currencies since Donald Trump's shock win in the US presidential election. The Mexican peso has declined nearly 13 per cent, the South African Rand and Turkish Lira have fallen by 7.5 per cent this month.

Analysts said they expected the rupee to remain under pressure, and can fall to as much as 70 in the near term, depending on global conditions.

"This is a dollar strength story and we need to depreciate against developing markets to maintain the competitiveness of the exchange rate," said Ashish Vaidya, head of trading at DBS Bank in Mumbai.

In 2013, pressure on the current account triggered heavy selling in the rupee, but India is being seen as far better positioned now to resist outflows from investors attracted by higher US interest rates.

Forex reserves at $367 billion are also in a comfortable position and the current account deficit is well under control.

Back in August 2013, the rupee swooned to a low of 68.85 against the dollar on fears that the US Federal Reserve would start tapering its $85 billion-a-month bond buying binge that had funnelled cheap money to the most distant parts of the world.

The Fed had signalled its intention to reduce bond purchases in May 2013 but didn't pull the trigger until December, casting a pall of uncertainty in the markets during the intervening period.

In fact, one of the first steps that Raghuram Rajan took after assuming charge as governor of the RBI in September 2013 was to float three-year FCNR (B) bonds which raised $26 billion despite his initial misgivings about the benefits of such a course of action.

The bonds will be largely redeemed this month with an expected outflow of $20 billion and analysts said, the redemption was putting pressure on the rupee.

The fall in the rupee's value should, however, mean good news to exporters though it will also lead to some anxiety among those companies whose foreign currency convertible bond payments are due.

According to Abhishek Goenka, CEO of IFA Global, a forex treasury and consulting company, the dollar has continued to strengthen on expectations of an interest rate hike by the Federal Reserve in its December meeting.

Fed rate hike expectations have led to foreign portfolio investors selling in the emerging markets.

FPIs have withdrawn $3 billion from both the equity and debt markets, thus weighing on the domestic currency.

In debt, the lure of US treasuries is growing on expectations that Trump will follow an expansionary policy even as Indian government securities remain soft following demonetisation.

For the markets and the rupee, there is an added concern over demonetisation. The fear is that this move by the Centre would crimp economic growth in the near term.

A note from Edelweiss, however, says: "This appears to be a short term trend and long term dynamics dictates a stable rupee due to falling inflation, contracting interest rate and inflation differentials with major trading partners.''

Meanwhile gold prices today slipped to its over seven-month low in Mumbai, snapping its three-day winning spree,