Two Adani group firms including flagship Adani Enterprises Ltd are cumulatively raising around $2.56 billion or Rs 21,000 crore through a share sale to institutional investors.

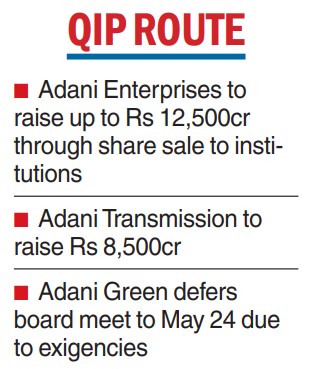

In a regulatory filing to the stock exchanges, Adani Enterprises said on Saturday its board has approved “raising of funds by way of issuance of equity shares having face value of Rs 1 each of the company and/or other eligible securities or any combination thereof, for an aggregate amount not exceeding Rs 12,500 crore or an equivalent amount thereof by way of qualified institutional placement (QIP) or other permissible mode in accordance with the applicable laws”.

Adani Transmission said in a separate filing that its board has approved a proposal to raise Rs 8,500 crore by way of QIP or another permissible mode in accordance with the applicable laws.

Three Adani entities — Adani Enterprises, Adani Transmission and Adani Green Energy — had announced on Thursday their boards would meet to decide on raising capital.

However, the board meeting of Adani Green Energy was postponed to May 24 because of ``certain exigencies’’.

A QIP is made to qualified institutional buyers that include foreign portfolio investors, mutual funds, financial institutions, insurance companies and pension firms.

The QIPs will be the first major test of the group after Adani Enterprises withdrew its Rs 20,000 crore FPO following the Hindenburg report.

The offer was fully subscribed but the company returned the money to subscribers. The sources said the company stock which was offered in the price range of Rs 3,112 to Rs 3,276 in the FPO is now available at Rs 1,964 (at Friday’s closing price).

The damaging allegations had at point of time wiped out more than $140 billion of its market capitalisation. The conglomerate has denied all the allegations made by the US-based short seller.

Subsequently, the group held road shows with fixed income investors in multiple locations such as London, Hong Kong, Singapore and Dubai to reassure them about its finances.

The group has also been focussing on bringing down debt levels and repaying bonds. It repaid more than $2.15 billion of margin linked share-backed financing.

During the January-March period, it reportedly made a payment of another $3 billion which also included settlement of bonds with mutual funds.

On Thursday, Adani Ports and Special Economic Zone announced the successful early settlement of notes tendered by its bond holders following its offer to buy back debt. The company disclosed that it has paid $127.4 million and an accrued interest of $9.9375 per $1,000, of the notes.

While all the group shares took a big beating on the bourses following the Hindenburg report, they have over the past few weeks recovered from the lows after the conglomerate brought down debt levels and GQG Partners invested nearly $ 1.90 billion in four companies — Adani Enterprises, Adani Green Energy, Adani Transmission and Adani Ports & SEZ.

However, all the shares are still away from their highs that prevailed before Hindenburg released its report.

Market circles said that though its listed shares are relatively more stable now, the Adani QIP issue will be a big test for the group and if successful, it may come out with similar issues for other firmsl.

The market watchers said the decision to raise such a large sum may be a sign the group has already received positive response from overseas investors.

“The fact that they have announced it implies to me that the funding has been locked up,” said Varun Khandelwal, director at Bullero Capital, a New Delhi-based proprietary trading firm. “This will help them reduce pledges and it’s a show of strength.”

Adani Enterprises Ltd reported a net profit of Rs 722.48 crore in the fourth quarter of the last fiscal on the back of healthy growth in airports and road businesses.

With inputs from Reuters