Gautam Adani on Sunday won the race to acquire Holcim’s assets in India in a $10.5-billion deal that will catapult him to second in the cement league behind Kumar Mangalam Birla’s UltraTech.

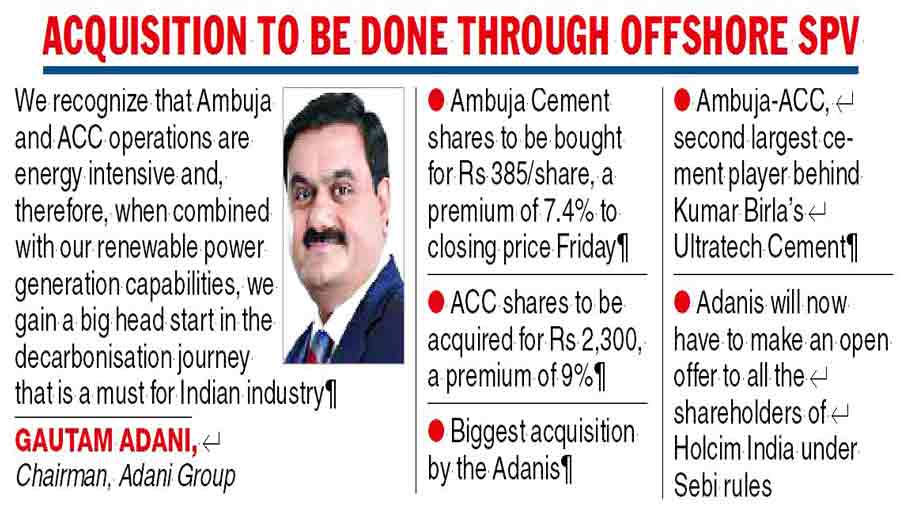

In a late evening announcement, the Adani group which has a market capitalisation of nearly $177.54 billion said the promoter family through an offshore special purpose vehicle has entered into definitive agreements for the acquisition of the Swiss parent’s entire stake in Ambuja Cements and ACC.

Adani will pay Rs 385 per share for Ambuja Cement and Rs 2,300 apiece for a 4.48 per cent direct stake which Holcim holds in ACC.

Holcim holds 63.19 per cent in Ambuja Cements and 54.53 per cent in ACC, of which 50.05 per cent is held through Ambuja Cements. Adani snapped up the assets that have a combined capacity of nearly 70 million tonnes by beating the Sajjan Jindal-led JSW group. UltraTech Cement, the AV Birla group firm, was also in the fray.

On Friday, the shares of Ambuja Cements closed lower around 3.80 per cent at Rs 358.80, giving it a market capitalisation of Rs 71,244.95 crore.

On the other hand, the ACC counter fell over three per cent to settle at Rs 2,113.70. It currently has a market capitalisation of Rs 39,692.59 crore.

Therefore, the acquisition price denotes a premium of nearly 7.40 per cent to the closing price of the Ambuja Cement and a premium of nearly 9 per cent in the case of ACC.

Since the acquisition of the stake will lead to a change in management control, Adani will now have to make an open offer to the public shareholders of both the companies in lne with Sebi rules.

The Adani group said that the value for the Holcim stake and the open offer consideration for Ambuja Cements and ACC is $10.5 billion, which makes it the largest ever acquisition by the conglomerate and India’s largest ever M&A transaction in the infrastructure and materials space.

The acquisition will see the Adani group gain access to not only well recognised brands but also a huge depth of manufacturing and supply chain infrastructure — through 23 cement plants, 14 grinding stations, 80 ready-mix concrete plants and over 50,000 channel partners in the country.

Adani said both Ambuja and ACC will benefit from synergies with the integrated infrastructure platform of his group, particularly in the areas of raw material, renewable power and logistics.

The Adani group chief added that while its portfolio firms have vast experience and deep expertise, both ACC and Ambuja Cements can expect higher margins and return on capital employed.

“Ambuja Cements and ACC are two of the strongest brands across India. When augmented with our renewable power generation footprint, we gain a big headstart in the decarbonisation journey that is a must for cement production,” Adani said.

“This combination of all our capabilities makes me confident that we will be able to establish the cleanest and most sustainable cement manufacturing processes that will meet or exceed global benchmarks,’’ he observed.

The race for control of Holcim’s cement business in India was largely between Adani and Jindal. The latter had recently said that the group will offer $7 billion to Holcim that includes $4.5 billion as its own equity and $2.5 billion from undisclosed private equity partners.