Calcutta has more unsold office space than any other Tier I city and real estate in Rajarhat, long regarded as the bellwether of growth in Bengal, is bleeding with one in three units vacant, according to data collated from various sources.

A report by international property consultancy Jones Lang LaSalle says real estate in Rajarhat has performed "lower than expected" among nine townships primarily because of the Mamata Banerjee government's stand on special economic zones.

"Rajarhat enjoyed speculative growth three to five years ago, but it was not matched by a good rate of growth in infrastructure. Overall, Rajarhat hasn't been able to drive the kind of economic and employment-generating activity that was initially planned," Ashutosh Limaye, national director of research at Jones Lang LaSalle, states in his report A Tale of Two Hotspots: Gachibowli and Rajarhat.

The report contrasts Rajarhat's unfulfilled potential with the surge in economic activity in Gachibowli, the Rajarhat of Hyderabad, once DLF Cyber City set up base there. Top companies like Infosys, Wipro, CMC, Capgemini and Polaris followed, triggering a spike in demand for residential apartments and villas in and around the satellite township.

While Gachibowli has exceeded expectations, the picture in Rajarhat is far from rosy. "The current government's stand against new SEZs has resulted in a stalemate with Infosys for the latter's SEZ in Rajarhat-New Town. The SEZ status is not expected to come on account of the current government's political compulsions. While one phase of DLF's SEZ is complete, the other phase is in jeopardy. Wipro's SEZ is in a similar situation. Unitech's SEZ is partly operational, while the rest is under construction at a very slow pace," the report states.

According to Jones Lang LaSalle, DLF and Unitech as well as local players like Ambuja Neotia and the Mani Group had curtailed expansion plans in office space.

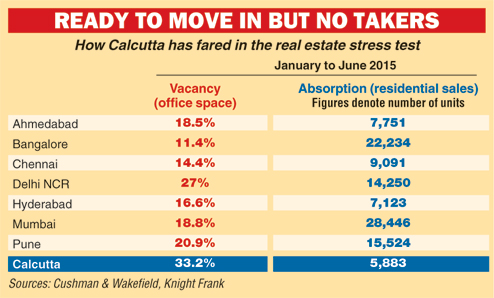

Cushman & Wakefield's report on office market last week explains why developers are cagey about putting more money into Calcutta. The report points out a 33.2 per cent vacancy in office space in the Calcutta market, the highest in India.

"Overall, demand remained subdued during the first half of this year too as major companies from the IT-ITeS sector, which used to be the dominant demand driver, have not expanded/started their operations in the city through leasing route," the report says.

This is despite sale/leasing growing 6 per cent in the first six months of the year.

"If I fill a hole, another is created," said a developer who operates an IT park in Sector V, Salt Lake, illustrating the challenge of attracting new tenants while retaining the old ones.

"We have been reducing unit sizes to make them affordable. I started with 3,000sq ft units but am now eager to sell even 600sq ft," said another IT park developer in New Town.

The residential segment is hurting too. Property consultant Knight Frank said industrial growth was integral to the health of the residential market.

"If sales of office space improve, which would be a mark of economic activity, there will be growth in the residential segment as well. There has to be more economic development so that jobs are created," said Samantak Das, chief economist and national director of research at Knight Frank.

According to his report, released on Monday, Calcutta ranks last among eight cities in terms of sales in the residential segment during the first half of 2015.

This is despite Delhi and Mumbai reporting a greater dip in sales over the previous six months.

Das identified syndicates as the "troublemaker" deterring growth.

If there is optimism, it is because of new launches in the residential segment, where Calcutta is ahead of Hyderabad and Ahmedabad. Knight Frank is betting on better sales in the second half of the year, provided demand for office increases.

Das said real estate prices had dropped only marginally in Calcutta compared to other cities mostly because there wasn't much scope for reduction.