The CGST commissionerate in Siliguri has exposed an organised racket of fudging export figures to Bhutan to earn extra GST refund from the Centre.

The racketeers, sources said, are based in Jaigaon town, Alipurduar district, that sits on the India-Bhutan border. Phuentsholing, the commercial capital of Bhutan, is located on the other side of the border.

“It was found that a section of people who claim to be exporters would claim a refund on GST on the pretext of exporting goods to Bhutan. Our probe found that they showed on paper that they exported items to Bhutan, but in reality, they did not and simply fudged documents,” said an official posted at the CGST commissionerate in Siliguri.

“Goods shown as being exported to Bhutan are being sold in the local market without invoices at cheap prices. This is a blatant violation of the government’s policy of one nation, one tax. These people simply misused the government’s policy to provide GST refund benefits to genuine exporters,” he added.

For Indian goods exported to Bhutan, the exporters get a refund of the GST in different percentages, depending on the type of commodity.

As the authorities continued the probe, they found that the land customs station (LCS) at Jaigaon on the Indian side is around 1.5km from the entry point to Bhutan.

“There are instances where goods are loaded to show that those would go to Bhutan. But after crossing the LCS, the vehicles with such goods move through bylanes to reach other markets of north Bengal and Assam and unload the items,” said another official who is privy to the issue.

He pointed out that eventually, such goods are sold in the Indian market. “These people have connections across the border through whom they get funds transferred to prove that they have received payments. For a section of people, this has become a lucrative deal,”

he added.

Items such as pan masala, gutkha, cigarette, cigar, tobacco, cold drinks, tyres, cell phone, sanitary items, tiles and marble are shown to be exported to Bhutan but are sold in local markets.

“This is a serious offence as these people have claimed GST refund from the Centre. This means they have taken out money from the government treasury by fudging export figures,” the official added.

The data available with the CGST commissionerate in Siliguri shows that since 2017, when GST was introduced, the quantum of refund claims has surged in Jaigaon.

In 2017-18, the refund claim was ₹4 crore. It increased to ₹164.75 crore in 2022-23. In 2024-25, the refund claim was ₹148.86 crore.

“The exports, however, didn’t increase correspondingly,” the official added.

Though cases were filed by CGST authorities earlier, refund claims kept climbing.

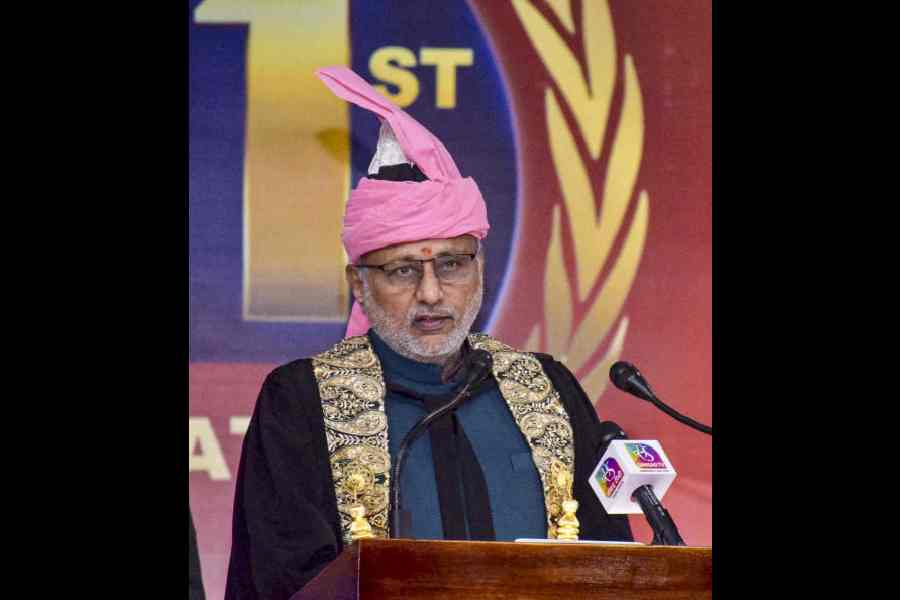

In August 2024, when Jeetesh Nagori assumed the commissioner’s post, he took up the task to ensure that documents and other details are properly verified before a refund claim was approved.

Cases were registered against fake suppliers who produced fake invoices, and export was verified with the data maintained by the security forces, Customs and the Bhutan government at the border. Eventually, three persons were arrested.

An official involved in the probe said that the quantum of refund claims had reduced. In 2024-25, claims for GST refund to the tune of ₹38 crore were submitted to the CGST authorities by Jaigaon exporters over a two-month period, he said. In the same corresponding period of 2025-26, the claim has come down to ₹13.7 crore, he said. “In case of some products, no claim was filed. However, our drive will continue until the practice is completely stopped,” the CGST official said.