|

To fill up its coffers, the Calcutta Municipal Corporation (CMC) is going after taxpayers whose cheques had bounced.

If the taxpayers had not been intimated about the bounced cheques on time, they will be allowed to clear the dues without paying interest and fine. Those who had been told of the bounced cheques on time will have to cough up interest and penalty along with the dues.

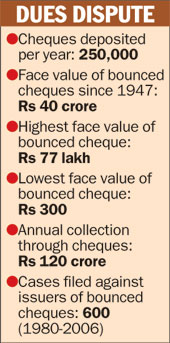

Over 250,000 cheques are deposited with the CMC every year to pay property tax, trade licence fees, mutation fees, water connection charges and commercial water charges. About 70 per cent of the cheques are related to property tax.

Over 60,000 bounced cheques, with a face value of Rs 40 crore, have piled up in the assessment department since 1947. According to a civic estimate, about Rs 25 crore can be realised immediately if the face value of the bounced cheques is accepted in cash without penalty and interest.

The face value of the bounced cheques could not be realised by the CMC due to either a communication gap between the assessment and revenue departments or claim of interest and penalty on the outstanding amount.

Until recently, it used to take several years for the assessment department to inform a house-owner that his cheque had bounced. Even if the house-owner wanted to clear the dues immediately, the civic body refused to accept the payment without penalty and interest.

In addition, 15,000 bounced cheques have been tracked down against which steps had not been taken by the civic body.

Municipal commissioner Alapan Bandyopadhyay has convened a meeting with officials of the assessment and revenue departments to convey the decision of the authorities. The move follows a suggestion by Pricewaterhouse Coopers.