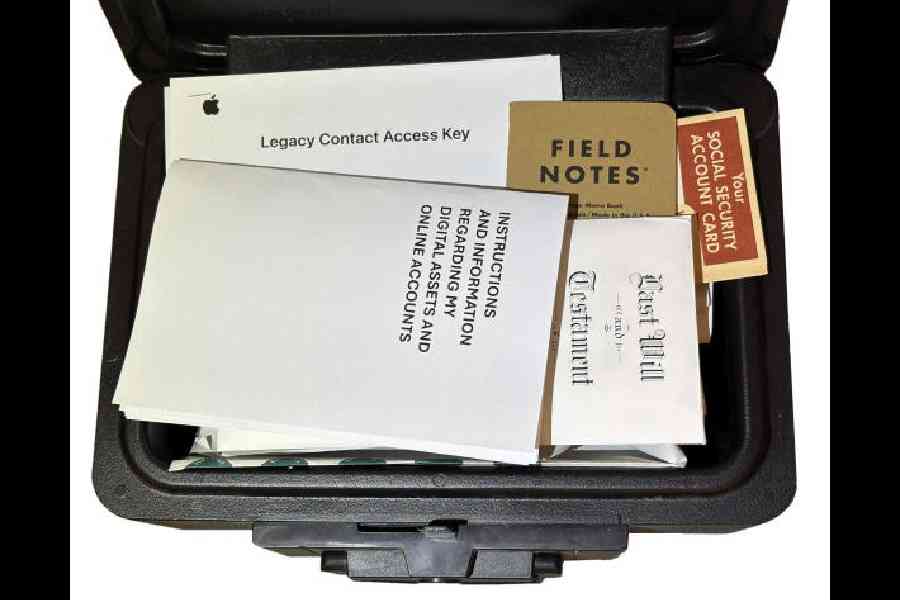

Create a document stipulating how you want your online accounts and all digital content handled when you die or become incapacitated, and keep it with your other estate papers.

Giving access to your usernames and passwords will greatly help your representative, but proceed carefully. You will need a safe place to list the credentials for all your financial institutions, as well as for any e-commerce stores, insurance policies, online storage, email, social media platforms, cable and wireless carriers, medical apps and media subscriptions.

One way to encrypt and store this sensitive information is to enter it all into a password-manager app. Wirecutter, the product review site owned by The New York Times, recommends 1Password ($3 a month for individual plan) or Bitwarden (free, with in-app upgrades). Apple and Google have their own free apps.

If you want an analog option, print out the list or write everything down in a notebook. Keep it updated, but make sure the list is locked in a home safe or another secured location, as it would be a gold mine for identity thieves.

Don’t forget to note the passwords and passcodes needed to get into your password manager app, phone, computer or tablet; most manufacturers can’t bypass a PIN code without erasing the device. Your survivors may need your contact list to tell people you’ve passed, and your phone for any two-factor authentication codes.

Legacy contact

Along with compiling your digital directive and passwords, you should consider adding someone you trust as a “legacy contact” for your Apple, Google, Facebook and other accounts. A legacy contact is the person you choose to handle that account after you’re gone.

Apple added a legacy contact feature to its software in 2021 and lets you select a manager for your Apple account used with iPhones, iPads and Macs. To set it up, go into your system settings on the device, select your name and then Sign In & Security, and choose Legacy Contact.

Google has an Inactive Account Manager tool for dealing with your Google Account if you are not able to use it. To set it up, visit the Data & Privacy settings of your account.

Facebook has a legacy contact setting as well as a setting to delete your account when the company is notified of your death. For sites that don’t let you designate a person, your executor typically must contact the company and request the account be deleted or memorialised.

Apple, Google and Microsoft are among those with account-deletion steps on their sites. Facebook, as well as other social sites, has a tool to download the photos and other content from an account before you delete it, as does Google with its Google Takeout feature.

No instructions

If you’re the person handling an estate for someone who didn’t plan for their digital legacy, your administration experience may take more time. But even if you did not receive instructions, you should try to shutter social-media profiles and other accounts to avoid misuse.

Just as you would inform financial and insurance firms of the person’s death, you should notify the social media and request they close the deceased’s accounts. This typically requires providing a death certificate, an obituary, letters testamentary, your personal identification and other files. Digitised copies are often accepted.

The help sections of Instagram, LinkedIn, Microsoft, PayPal, X, Yahoo and other sites have instructions for account access and closures, as do those of Apple and Google. In many cases, you can request the account’s content, although this may require submitting even more legal documentation to the company.

Managing the digital assets of a deceased person without instructions can make a difficult time even harder — which is all the more reason to leave your loved ones everything they need.

NYTNS